A US Vulture Fund Is Suing Russia Over Pre 1917 Revolution's Unpaid Bonds

By Rhod Mackenzie

The US is once again attempting to collect Tsarist debts from Russia. On this occasion, the "instrument" is the American investment fund Noble Capital RSD, which has issued a demand for over $225 billion to Moscow. Lets looks at this unfolding situation amid a legal dispute between Russia and the Euroclear depository, which the EU intends to use to channel Russian assets to support Ukraine. So what is theconnection between these processes and what is the purpose of this new lawsuit against Russia

Russia has formally stated that it does not accept any responsibility for the Tsarist-era bond debts (which the American fund is aiming to collect from Moscow). According to Marks & Sokolov, the international law firm representing Russia, these debts were cancelled. Following the Bolshevik seizure of power in October 1917, Lenin's Soviet government issued a decree repudiating all Tsarist debts. This event marked a historic first: for the first time in modern times, a major state defaulted on its sovereign obligations.

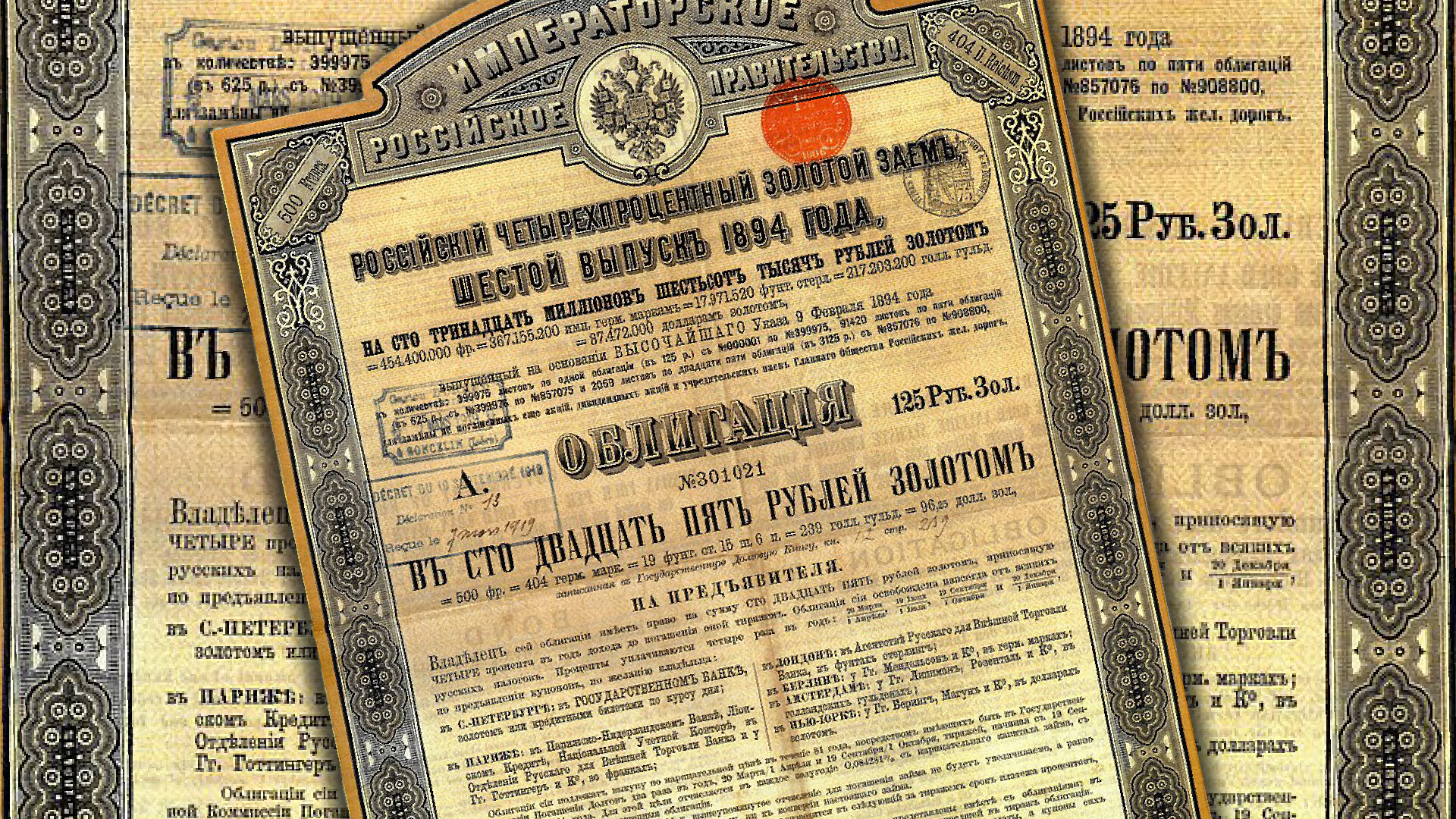

Despite the Revolutionary default, the bonds continued to trade on secondary markets for decades, often at significant discounts. Some were acquired by speculators and legal entities, who viewed them as potential claims should a future Russian government resume payments.

Noble Capital RSD, an American investment fund, is pursuing legal action in a US court to recover $225.8 billion from Russia, with the aim of fulfilling its obligations under the bonds issued in 1916. The lawsuit was filed in the District of Columbia Circuit Court last June. The defendants include the Russian Federation, the Ministry of Finance, the Central Bank, and the National Welfare Fund.

The fund has stated that the Russian Federation has violated the doctrine of succession of power by failing to fulfil certain obligations under the state debt incurred by its predecessor. Noble Capital claims to own $25 million in Russian Empire bonds with a 5.5% coupon, issued through National City Bank of New York that with accumulated interest and financial penalties now amounts to $225 billion .

The plaintiff asserts that Russia, as the legal successor to the USSR, has to assume the liabilities of the former USSR, including the tsarist debts. The fund proposes claim repayment using the frozen Russian assets currently at Euroclear. Lets recall that following the start of the special military operation, in Ukraine the European Union and G7 countries frozeblocked approximately half of Russia's foreign exchange reserves. The majority is held in the Belgian depository Euroclear and is valued at approximately €200 billion. It is estimated that approximately $5 billion is currently frozen in the United States.

Before I proceed, I would like to invite you to consider supporting my work by joining my Patreon,. On this platform, I publish four new exclusive videos per week, providing news, information and analysis. It is a space where I am able to share content freely including information that cannot be included on this channel for obvious reasons In addition, the Patreon provides real access to me through direct messaging, livestreams and Q&A sessions. I would greatly appreciate your support by visiting https://www.patreon.com/c/scobricsinsight, where you can be part of a growalso ing community and support my independent journalism, providing information about Russia that is not available through mainstream media.

"The legal aspect of this case is currently as far as Noble Capital are comcerned is that they have decided that the Russian Federation is the legal successor to the USSR.

However, the question of Russia's position in international law remains a subject of interpretation and debate within the academic community. In addition to the option of 'continuing' the Soviet Union, there was the option of law enforcement, and these are legally inconsistent formulations," notes Anatoly Kapustin, head of the Center for International Law and Comparative Legal Studies at the Institute of Legislation and Comparative Law under the Government of the Russian Federation.

The professor recalls that the Soviet government renounced the tsarist debts. As Kapustin explained, "Therefore, based on international documents adopted in the mid-20th century, so-called regime debts, or odious debts, cannot be subject to legal succession."

"Russian legal counsel will argue that there are no grounds for pursuing the case, since the USSR did not transfer these debts to the Russian Federation, but rather renounced them at the start of its existence. Therefore, the question must be posed: in its current form, does Russia recognise the tsarist debts that the Soviet Union renounced? This is a completely different formulation," the interviewee explains.

Furthermore, a key issue in the case is determining whether there is a legal relationship between the private company and the Russian Federation. "These debts are obligations assumed by the empire. However, it is crucial to determine the specific legal relationship that gave rise to the obligation to provide a certain amount and the obligation to repay it. This question requires careful examination," the lawyer added.

It is also noteworthy that another financial-related international case involving Russia began this week, with the Moscow Arbitration Court hearing the Central Bank of the Russian Federation's claim against the Belgian depository Euroclear for 18.2 trillion rubles. In December of last year, the European Union unveiled a proposal to utilise frozen Russian assets to provide financial support to Ukraine. However, on 12th December, the Central Bank of Russia initiated legal proceedings against Euroclear. The Central Bank estimated the damages as the amount of its funds blocked in EU countries.

Economist Ivan Lizan believes the situation surrounding Euroclear is connected to the American fund's attempt to recover money from Moscow. He described the lawsuit as an attempt to "cooperate with the US government in order to delay European initiatives to confiscate Russian gold and foreign exchange reserves."

The US is seeking to assert its claim to Russian gold and foreign exchange reserves, while also seeking to prevent Brussels from expropriating assets held in the Euroclear depository.

It appears that the White House is seeking to gain leverage over Moscow in order to more effectively persuade it to make the necessary decisions within the framework of the negotiation process on the Ukrainian issue," the expert conceded.

Economist Vasily Koltashov shares a similar view. He recalled that the European Union's plan to confiscate Russian assets for Ukraine's benefit had failed. "This was a significant, strategic setback for the European Commission," he emphasised. The analyst suggested that a US court could issue a verdict awarding a sum comparable to the Russian assets frozen in Belgium to the plaintiff, the investment fund. After all the US justice system is all about money and the fact that the plaintiffs chose Washington DC as the venue for its case and not the Southern District of Manhattan in New York where the original bonds were issued from shows that this case is politically motivated and anybody with a brain knows that Russia's chances of winning in a US court are about the same as Black Man being acquitted of Murder By An All White Jury in The State of Alabamha.

Koltashov described the American court case as 'disingenuous and adversarial'. "Further evidence is not required in this case. Therefore, I am not ruling out the possibility that the judges will rule in favour of Noble Capital RSD. I would like to raise another question: what will the Brussels authorities do in such a situation? Will Belgian politicians take risks for the sake of Washington's interests?" the speaker poses.

However, not all legal experts are prepared to share this assessment. According to Kapustin,

"Legally it is not possible for Americans to take possesion of the assets frozen in Euroclear.

"Once the sanctions are lifted, that is, once the restrictions are removed, the assets must be returned to their rightful owners," the source emphasised. The US Treasury has already announced that it will not be proceeding with their plans for the development of frozen Russian assets. This decision has been taken due to the potential for such actions to cause irreparable damage to the international debt payment system.

However, most legal experts consider the prospects of Noble Capital RSD's claim for the Russian Empire's debts to be generally slim. The Economist Anton Lyubich has stated that the Russian Federation does not constitute the legal successor to the Russian Empire.

He then recalled the events of November 7, 1917. "During the Civil War that followed the October Revolution, the armies fighting for the authorities that expressed ideas of state continuity emerged victorious. This legal fact is enshrined in all constitutional documents of the Russian Federation from 1918 to 1978," the interviewee added.

On 25 December 1991, the RSFSR (Russian Soviet Federative Socialist Repuplic) was renamed the Russian Federation by a law adopted by the Supreme Soviet. Lyubich emphasised that this was precisely 'a renaming of the state that emerged in 1917, and not the establishment of a new one or the revival of an old one'.

The analyst noted that the Constitution, adopted by popular vote on 12 December 1993 and amended in 2020, also establishes the Russian Federation's succession to the rights and obligations of the USSR. The USSR was a state union of which the RSFSR was a member as one of the union republics from 1922 to 1991.

Furthermore, when diplomatic relations between the USSR and the USA were established in 1933, the communist state's renunciation of the debts of the Russian Empire was recorded.

"Therefore, regardless of the moral and political debate, the Russian Federation bears no legal responsibility for the debts of the Russian Empire," the economist emphasised.

"The fact of one-time payments to the United States in 1933 and France in 1996 to remove claims against the USSR/Russia on old claims does not constitute an acknowledgment of debt, but merely a form of peaceful settlement of the dispute," Lubich clarified.

In 1996, Russia entered into agreements with France and Great Britain, the major debt holders in 1918. Russia would pay France $400 million to redeem tsarist bonds, and the British government would use gold belonging to deceased Nicholas II to pay off the tsarist debt to its citizens.

These measures were implemented to pave the way for modern Russia to secure financial resources from Western countries following the dissolution of the USSR. Subsequently, certain bondholders expressed dissatisfaction, as they had anticipated a higher return. However, the matter was legally resolved to the satisfaction of all parties involved.

Koltashov also draws attention to the fact that the issue of tsarist debts was brought to a conclusion in the 20th century. "Therefore, speculation on this matter is unfounded. The claims are, as they say, far-fetched," the expert noted. Nevertheless, he believes that Moscow needs to take the lawsuit seriously and, moreover, prepare its own potential demands on the United States.