China's new chip making breakthrough

The war of chip makers just took a new turn . Last week, China announced the creation of photolithographic machines capable of producing chips using a very level high technological process — above 8 nm. This is a leap of over a decade and a half of progress in these technologies.So why is this so important and how it will change the global semiconductor market not only for China but its allies in the BRICS like India and Russia.

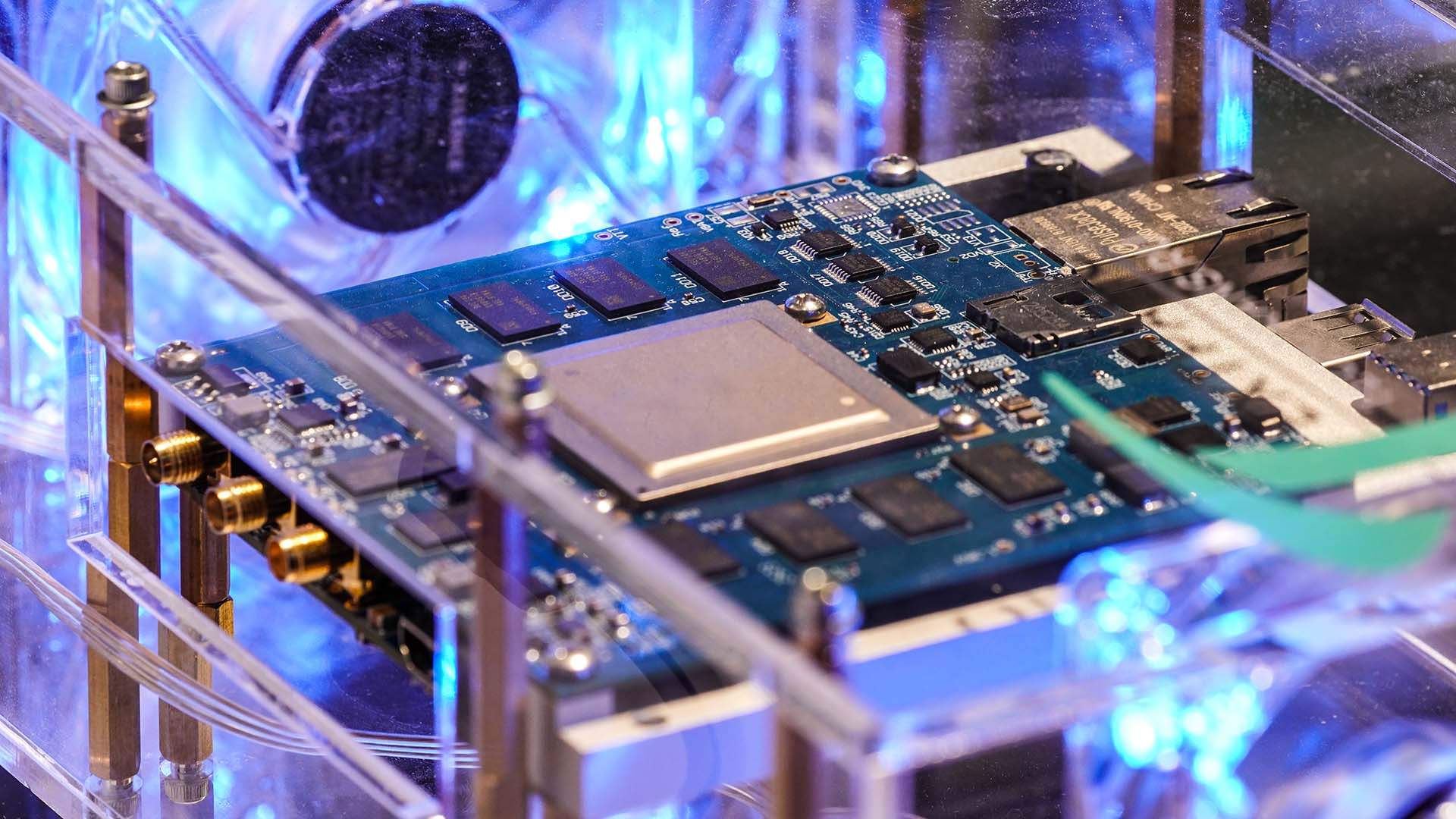

It is difficult to find technology in the 21st century that does not use microchips. It is, in fact, the case that chips are a related field for almost all other industries. Furthermore, it is a technically complex industry that requires specific competencies and equipment. The number of countries with the capacity to do this in principle is limited: Taiwan, mainland China, South Korea, Japan, the USA, with almost no others. There is a significant gap within this group, with the most advanced microchips currently produced only by Taiwan, represented by the TSMC corporation.

However, while the production of semiconductors is concentrated in a few countries and companies, the production of the means of production for them is almost completely monopolised on a global scale. We are talking about photolithographic machines, which are necessary for applying a pattern to a board, a kind of "machine" for chips. Formally, such machines are produced by several companies, but truly modern chips can only be made on equipment from the Dutch company ASML.

The company was once a small division of the once great Dutch electronics companyPhilips,it has grown rapidly as the company has enjoyed considerable success by consistently investing in extreme ultraviolet (EUV) photolithography, a technology it has been developing for decades. Despite experiencinglarge losses over a number of years, it persevred and their technology finally gained traction in the 2010s.

From 7 nm onwards, the majority of manufacturers utilise EUV equipment as their primary choice (with the exception of China, why that is I will talkd about later in this videos so stick around for all the details). Now by the end of the last decade, ASML had become the dominant player in the global market.

Now before I continue I would like to make an appeal,if you like and enjoy my videos you can help me fund the channel and my websited sco brics insight .com and to further develop it. You can do this by making a small donation which you can do by clicking on the thanks button at the bottom of the video screen. Everybody who donates does get a personal thank you from me.

The cost of photolithographic equipment and its maintenance represents approximately 40% of the total cost of chip production. The price of an ASML machine is comparable to that of an Airbus airliner, and in terms of its physical dimensions, one such machine exceeds the size and dimensions of a regular double decker bus (and is approximately one thousand times the weight).

Indeed, it is actually a mini-factory in its own right. ASML's monopoly position in the market enables it to set prices at its own discretion. It would be inaccurate to suggest that the Dutch company exploits this position frequently. However, the lack of competition in any case causes concern among chip manufacturers. Furthermore, there have been instances of delayed deliveries, and most notably, in recent years, the issue of semiconductor production has become highly politicised.

Firstly, issues emerged with China, which increased its market share year on year. In the early 2010s, China's share of global production was slightly above zero, but now it has exceeded 20%. This coincided with a deterioration in US-China relations and the AI race, which requires significant quantities of semiconductors.

The US administration introduced restrictions on the supply of chips to China, which had a knock-on effect on US companies and market participants from other countries. However, Chinese companies continued to manufacture their own chips, which were of a highly advanced and modern design. To illustrate, the Chinese company Yangtze Memory Technologies (YTMC) expanded production of 3D NAND memory chips in 2023 (used, for example, in the production of SSDs – solid-state drives). Huawei, which was anticipated to be the first to feel the impact of the sanctions, significantly increased its own production last year.

China successfully established mass production of semiconductors using the 7 nm process technology (not the most modern, but sufficient for the vast majority of tasks) in sufficient quantities, which provided a respite for local electronics manufacturers.

The only way to exert some influence on China's position in the industry was to restrict the supply of photolithographic equipment. It should be noted that ASML declined to supply EUV to China some time ago. It was assumed that without these machines, production of 7-nanometre chips would be unfeasible.

However, the Chinese have demonstrated that previous-generation equipment is adequate for this process technology, utilising deep ultraviolet (DUV) technology. This approach is somewhat less efficient than using EUV, but it is more than profitable given the enormous demand in the market and generous subsidies for manufacturers. It is theoretically possible to use these machines for higher process technologies (5 nm).

Two years for 15

This summer, the US once again exerted pressure on China's counterparts in Asia and Europe. The Dutch government has announced its intention to consider imposing restrictions on the maintenance of DUV machines in China. It is worth noting that even before the sanctions were imposed, the Chinese were purchasing this equipment in reserve, which means that there is currently a sufficient supply. However, failure to carry out the requisite maintenance work could result in significant issues. For ASML, this represents a significant challenge, given that the company generates over half of its sales in China. Furthermore, China has significant leverage to impose counter-sanctions. As a result, no decision has yet been reached.

Nevertheless, China's reliance on foreign equipment renders its position vulnerable. In China, only one company, Shanghai Micro Electronics Equipment (SMEE), produces such machines. Until recently, however, its capacity was limited to producing primitive machines using 90 nm process technology, which was considered modern in 2003. This equipment is sufficient for producing chips used in military equipment. Consequently, the US argument that measures are being taken to limit the capabilities of the Chinese army and navy appeared unconvincing.

The restrictions have prompted the Chinese to pursue import substitution and the development of national alternatives, with the goal of establishing a comprehensive chip production cycle, beginning with equipment. The construction of photolithographic machines is a highly intricate process that demands a great deal of expertise. It is not feasible to operate on the basis of immediate necessity or at any cost. Nevertheless, in mid-September it came to light that an unnamed company (believed to be SMEE) had developed two machines capable of servicing 28 and 8 nm processes, respectively.

This is still a less competitive position than that of ASML, but for the Chinese, the progress is significant. It does look like they have achieved a significant breakthrough in the semiconductor industry, developing their capabilities in a relatively short period of time. For the first time in the world, chips on 7 nm process technologies began to be produced no later than 2017. This is already sufficient to produce microcircuits for both military and civilian industries. In fact, the only remaining area for China to develop is the production of some of the most advanced computer equipment, in particular, modern processors.

It should be noted that the current status of the production of these machines is unclear. It is uncertain whether this refers to serial production or only to prototypes. In any case, if the equipment is operational, integrating it into production will not be a significant challenge, given that Beijing is committed to achieving complete independence from foreign suppliers in the current market environment. The potential for operating at a loss during the initial stages, until the economy of scale is achieved, is unlikely to be a concern in China.

It was reported a year ago that SMEE had also registered patents for EUV technology equipment. It is not yet clear whether we are discussing machines that will soon be built and put into production or theoretical research. If the former, it will be possible to state that China has finally caught up with ASML and its need for foreign contractors will be much lower. However, this will not eliminate the need for foreign contractors entirely, as any player in the industry will require many parts from different countries to produce chips. Currently, this is a truly global industry.

If China can ensure the production of new equipment, it will be possible to conclude that the American sanctions not only failed to achieve their intended result, but had the opposite effect. The PRC is now attempting to localise semiconductor production as much as possible in order to avoid any further restrictions, which was not observed a few years ago.

China's anticipated achievements illustrate that, despite the intricate nature of photolithographic machine production, the objective of fostering the relevant industry is achievable under certain circumstances. This could have a significant impact on the global industry landscape, potentially nullifying the impact of sanctions. Third-party consumers stand to benefit from increased competition, which could lead to sector-wide improvements and potentially lower prices. For Russia, this could simplify the procurement of chips for both military and civilian applications.