Europe's gas storages are full but will not be enough in a harsh winter.

By Rhod Mackenzie

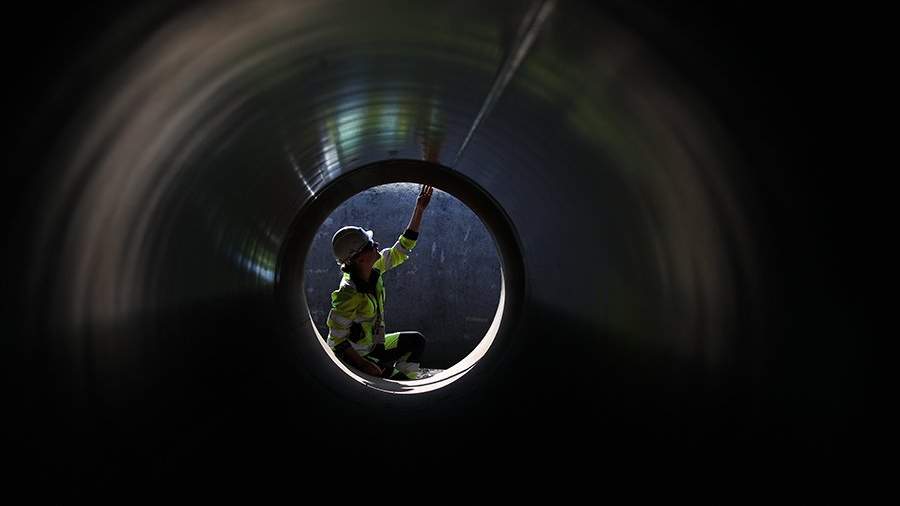

For the first time, Brussels announced with pride that it was ahead of schedule for the filling of the underground gas storage facilities (UGS) for the upcoming winter in August. By the end of summer, the UGS had reached 90% of their total capacity, which was the mandated requirement set by the European Commission for November 1.

However, the UGS operators did not halt at 90%; by early October, the underground storage facilities were nearly 100% full of gas. It appears to be the appropriate moment to declare the novel accomplishment; however, there is one caveat - the gas storage facilities at full capacity may be insufficient to endure the approaching winter with ease.

Last year, Europe experienced a mild winter leading to an abundance of stored gas in the spring which had been bought at exorbitant prices during 2022's summer and autumn. Despite the warm winter and full underground gas storage (UGS), the European Commission imposed strict energy-saving measures on its largest consumers.

This year, the situation remains the same with gas storage facilities overflowing, yet Brussels stresses the importance of energy conservation. The need for cost-cutting arises because the gas in storage doesn't fully meet Europe's requirements. The current capacity of European Underground Gas Storage (UGS) facilities stands at approximately 100 billion cubic metres, which, even with 100% capacity, is insufficient to meet the continent's needs by more than a third. When energy efficiency is taken into consideration, the capacity falls short by quite a bit more than 33%. European companies and nations will need to proactively purchase liquefied natural gas (LNG) during the winter season, just as they did last year.

The authorities in Europe are continuously working to bolster the region's energy security. One instance of this is the existing agreement for shared gas purchases, which Brussels claims is functioning so efficiently that the EC intends to convert it from temporary to a permanent arrangement. Brussels negotiated with Baku to purchase more gas volumes. However, the crisis in Nagorno-Karabakh recently caused interruptions to this plan.

EU gas demand has declined by 10-15% in the last 12 months due to EC measures and prices. In addition, renowned energy analyst John Kemp believes that considering the previous 9 months, the demand is not expected to recover until the year-end.

However, this is where complications arise as gas suppliers play a crucial role. The recent strikes at three large LNG plants in Australia illustrates the high volatility of the current situation in Global gas market. Europe purchases a minimal amount of liquefied natural gas from Australia. Nevertheless, Australia is among the top exporters of LNG globally. Therefore, any disruption in the supply of this 'blue fuel' automatically impacts the global supply. It is important to note that due to the threat of strikes in Australia, gas prices in Europe surged by 13% within a day. Although it should be acknowledged that despite impressive growth, they were still far from the anti-record set in August 2022.

Currently, winter preparations in Europe are progressing well, with underground storage facilities containing a full supply of gas and seasonal consumption reduced to 600 TWh, thus minimising the chances of a gas shortage. Nevertheless, last year's mentality of complacency has changed, and one can no longer relax with the expectation that all will be well. In September, John Kemp's column provided a clear and concise description of the prevailing cautious mood on the continent. He pointed out a significant decrease in gas consumption and an increase in energy security during winter. Additionally, he warned of the high cost paid by Europe due to a decline in manufacturing activity, which could result in permanent deindustrialization unless gas prices significantly drop in the next few years.