EU's Reality. It Needs Cheap Russian Energy

The European Commission President Ursula von der Leyen has finally acknowledged that the EU has suffered significant economic losses due to cutting off it major purchses of Russian energy resources. She has characterised the current situation as critical, emphasising that the EU's competitiveness is contingent on the resumption of low oil and gas prices.

However, she has cautioned that the opportunity to purchase energy at favourable rates has been missed, and the reliability of energy supplies is no longer a given. The economy is now facing the consequences of policies that may be questionable in their wisdom.

"Exorbitant energy costs"Von der Leyen stated that households and businesses are grappling with soaring energy expenses and many have yet to settle their bills.

She noted a 75% decline in gas imports from Russia, with the current share of Russian oil dropping to 3%, and the complete cessation of coal usage.The outcome is a decline in the viability of many major industry sectors , with production levels experiencing a significant drop.

"It is imperative that we diversify." she says

Von der Leyen acknowledged in the European Parliament that the EU's competitiveness is contingent on the return of low and stable energy prices. However, she believes that this can only be achieved by sourcing energy from alternative suppliers.

"We must diversify our energy sector and expand the use of environmentally friendly sources, including renewable ones, and in some countries, nuclear ones," she said.

So the deluded old Russaphobic harridan actually still does not get it the reliance on investement in renewables has cost her native Germany hundreds of billions of euros and resulted some of the world's highest electricy prices. Plus as far as diverifying supplies the have managed to alienate Qatar as supplier and become just as dependent on unreliable US LNG supplies now as they were on Russia's pipeline gas but at three times the cost

Now before I continue I would like to make an appeal,if you like and enjoy my videos you can help me fund the channel and my websited sco brics insight .com and to further develop it. You can do this by making a small donation which you can do by clicking on the thanks button at the bottom of the video screen. Everybody who donates does get a personal thank you from me.

In the EU especialy Germany In the energy-intensive sectors, the decline is already at -10% to -15%. The chemical and automobile industries are on the verge of bankruptyl, and the transfer of capacities out of the Eurozone to other regions of the World like Asia and the USA has become irreversible.

According to Eurostat, in the third quarter of 2024, the industrial production index for the EU as a whole fell to 98.3 (from 102.5 in the second quarter of 2022).

This is now the e phenomenon of the deindustrialiation of Europe

As noted by Mario Draghi, former ECB head, in his report "EU Competitiveness: A Look Ahead" for the European Commission, this is indeed deindustrialisation.The EC has assured us that the crisis will be overcome and that Russian energy resources would be replaced, but there are serious difficulties rhetoric with this as there are no cheaper energy resources other than Russian available on the World market and all the so called alternatives are much more expensive .

"Companies continue to suffer from high electricity prices - two to three times higher than in the US, and gas prices - four to five times higher. This discrepancy is primarily attributable to the absence of natural resources in Europe, compounded by underlying economic challenges, as highlighted in the document.

According to calculations referenced by Draghi, the EU's expenditure on fossil fuel imports has escalated from €341 billion in 2019 to €464 billion in 2023, constituting approximately 2.7% of GDP.

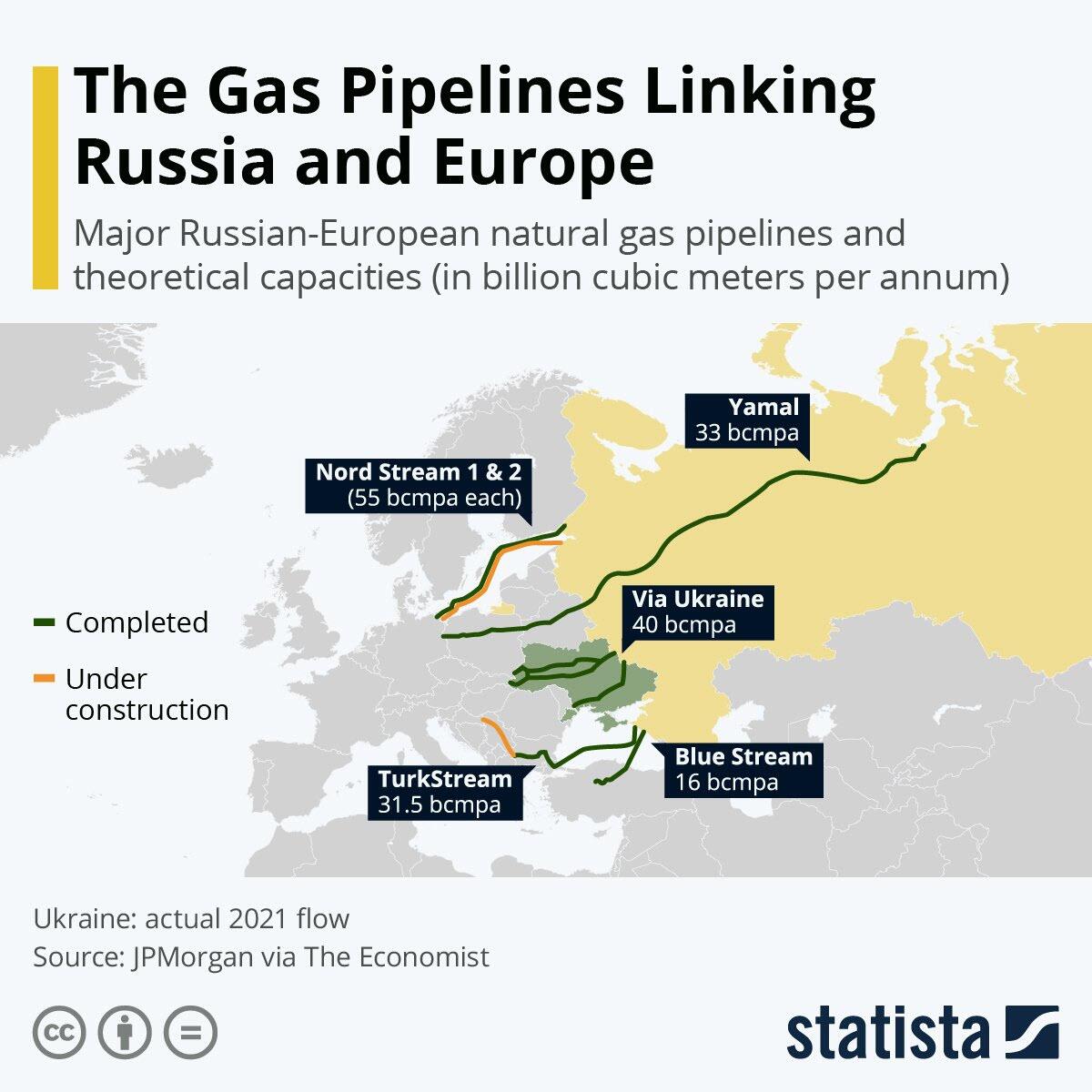

This is partly due to a decrease in pipeline supplies from Russia (from 40% in 2021 to eight in 2023) and an increase in liquefied gas purchases, which is on average at least 50% more expensive. As a result, the EU has fallen behind the US and China in competitveness. As the former head of the ECB emphasised, if energy costs are four times higher than competitors', then our idusstries cannot complete.

The current situation has been further complicated by the cessation of gas transit through Ukraine. Last year, approximately 15 billion cubic metres of gas entered the EU via this route, accounting for 4.5% of total consumption.

"It is evident that Europe is placing excessive reliance on alternative sources. The decarbonisation goal previously outlined by the head of the EC will further slow down the economy, Draghi warned. He added that fossil fuels "will continue to play a key role in energy pricing at least until the end of the decade."

The Green Plan has not been successful despite massive investments in green energy, electricity prices in EU countries exceed 200 euros per megawatt hour.

Tatyana Skryl, associate professor of the Department of Economic Theory at the Plekhanov Russian University of Economics, identifies the following factors as key: "Weather conditions, the high cost of infrastructure, its maintenance, and depreciation."

It is therefore not surprising that the EU is currently the leader in purchasing Russian liquefied natural gas. According to Rystad Energy, last year they purchased a record 17.8 million tons. In 2023, it was 15.1, and in 2022, it was 16.4.

The EU's reliance on Russian oil is even more pronounced. Furthermore, sanctions and circumvention strategies have led to significant cost escalations.Europe buys large amounts of Russia oil that is disguised as coming from Saudi Arabia,United Arab Emirates and India and it pays a premium for it because of the use of third parties.

Consequently, it is unlikely that electricity prices will decrease. Furthermore, Skryl notes that while government subsidies may have previously offset business expenses, the change in political leadership may hinder such support.

There are contradictions

As observers point out, the EU policy is contrary to common sense, as evidenced by the decline in industrial production due to the loss of competitiveness.

"The EU countries are gradually turning into markets for American energy resources, which are several times more expensive than Russian ones. The Eurozone's primary challenges stem from the erosion of its core sovereignty, with numerous heads of state and the EU leadership having been subjected to lobbying by the US and transnational companies based overseas," says Khadzhimurad Belkharoev, associate professor at the Institute of World Economy and Business, Faculty of Economics, RUDN University.

In a recent speech which comes three years after the beginning of the break in trade relations with Russia,Robert Habeck the Russhobe German Minister of Economy made h at the economic forum of the Handelsblatt newspaper. In this speech, he asked the Eurozone countries not to destroy the EU, but to start working for their own interests and "to meet the Trump administration with an outstretched hand, but not to let this hand be cut off." The remarks were made in the context of the energy crisis currently being experienced by the Old World, characterised by a shortage of energy resources, unaffordable prices for hydrocarbons and a loss of competitiveness.

Robert Habeck, in agreement with the head of the Austrian energy company OMV, Alfred Stern, has expressed concerns that the EU is dangerously reliant on liquefied natural gas supplies from the United States, just as it previously relied on Russian pipeline gas imports. However, the primary difference is that American "freedom molecules" are on average three times more expensive. While this may appear to be a familiar situation, it is crucial to recognise that Europe is not facing an end point with this development; rather, it is a temporary respite before the next phase of challenges.

The European Commission's decision to prioritize low prices from other suppliers, primarily the US, is also a point of concern.

The high value of energy resources, particularly blue fuel, sold by American companies to the EU, is well-documented. However, there are concerns about the stability of supplies, with a sharp drop in prices prompting an immediate reduction in production.Gas, like other fuels, is expected to rise in price, particularly in light of the decline in the EU's production potential.It is understandable that the final decision in Europe has been delayed, as there are growing disagreements.

While Habeck and Stern were delivering a sombre update from high platforms, in the US, the Freeport LNG liquefaction plant faced a near halt in production due to the impact of winter storm Enzo. According to American media reports, the terminal ceased operations on 21 January and is scheduled to resume production once the uninterruptible power supply is restored. Situated in Texas, a legal domestic offshore zone, the Freeport facility produces up to fifteen percent of all American LNG. Until recently, it was a source of pride for its owners and the entire country, as it is the first environmentally friendly production facility of its kind. Electric motors and drives are critical to liquefaction, compression and pumping processes, and these systems have been affected by power shortages over the past week.

The enterprise's operations will, naturally, be reinstated, but this serves as a further reason for those who prefer to place all their eggs in one basket to reconsider their strategy. A year ago, American gas carriers were already redirecting their routes, heading to Asia instead of the ports of the European Union. This was due to more attractive pricing in Asia.

This shift underscores the strategic importance of the European Union's energy policy and the need for its leaders to address these concerns. They have a comprehensive view of the current situation and are aware of all the risks, weighed down as they are by the mass of restrictions they have created themselves.

It is clear that Europe is now entering a decisive moment in history. The United States is preoccupied with addressing its domestic and geopolitical challenges, and is significantly more distant from the issues faced by a stagnant Europe. Additionally, several sources have reported that the Trump administration has decided to suspend bilateral relations with Brussels for an indefinite period, opting instead to engage directly with individual EU countries. This suggests that concerns about the potential impact of the new Washington administration on the cohesion of the European Union may have some foundation.

The leaders of the largest European states still have the opportunity to pull their countries out of their historical and economic nosedive by starting to work for their own benefit. Russia would undoubtedly welcome such a development.

Perhaps now with the intervention of Habeck and Stern joing the sensible voices of Viktor Orban of Hungary and Robert Fico of Slovakia perhaps then Fond of Lying and the others will move to make it easier to buy Russian fossil fuels before all industries in the EU disappear.

As reported by Bloomberg, the EC is expected to postpone the release of its plan to phase out fuel imports from Russia by 2027, which was scheduled for March 26. A group of ten countries has called for stricter sanctions against Moscow, according to the agency. However, the consent of all 27 EU members is required for this decision to be implemented.So given the growing opposition to it it is unlikely to happen