IEA warns of disruptions in strategic mineral supplies

By Rhod Mackenzie

The concentration of production of critical minerals (nickel, copper, lithium, etc.) in a small number of countries and the imposition of export restrictions by the 2030s could create serious problems for high-tech industries around the world. This is the conclusion reached by analysts from the International Energy Agency (IEA) in the Global Critical Minerals Outlook 2025 report, published on May 21. The distinctiveness and opacity of the markets for such metals leads to high price volatility and the risk of shortages.

It is imperative that you maintain your critical concentration.

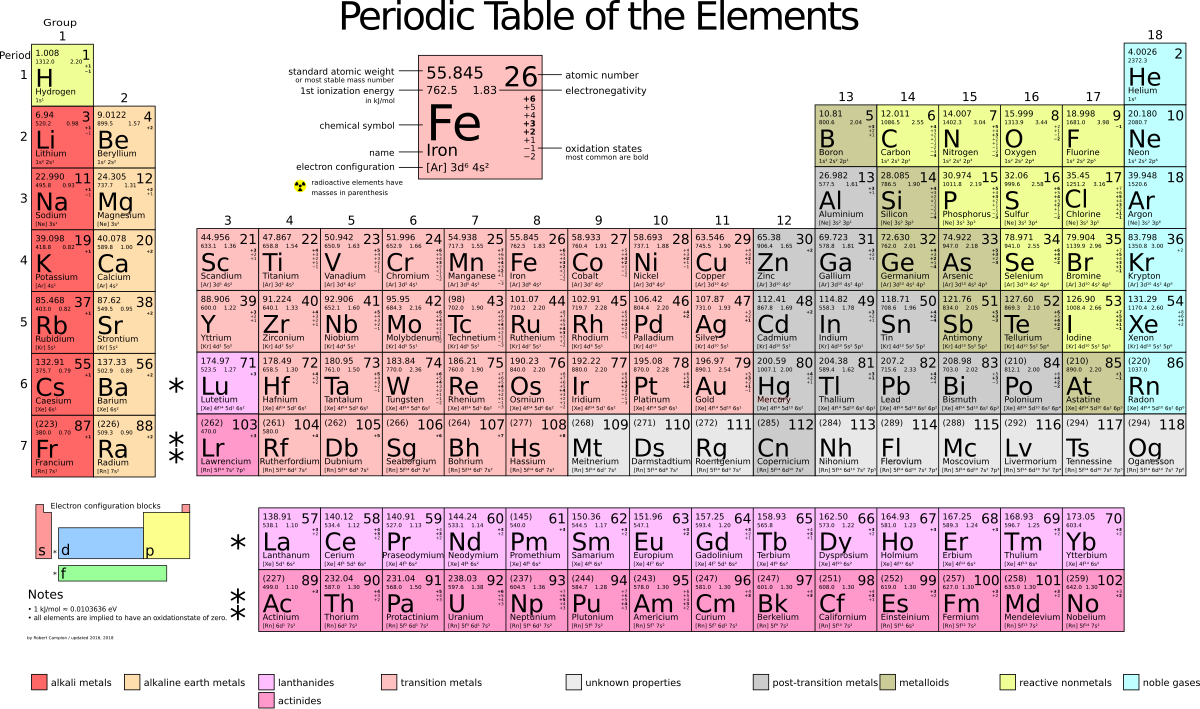

The global focus on critical minerals, including copper, nickel, lithium, cobalt, graphite and rare earth metals (REMs) such as zirconium, hafnium, vanadium, niobium and tantalum, persists. According to the IEA, the average market share of the three largest players (the top three are different for each raw material) increased from 82% in 2020 to 86% in 2024.

Concurrently, the augmentation in supplies to the global market for individual metals during this period was in the main (90%) sourced from a predominant supplier: Indonesia and Russia are key producers of nickel, while China is a major source of cobalt, graphite and Rare Earth Element. The authors of the report emphasise that "changes in foreign policy, supply disruptions or technical problems in these regions could have huge global consequences".

China has consistently been the leading producer of 19 out of 20 critical minerals (five metals and a group of 15 rare earth elements) that the IEA considers in its report.

China accounts for approximately 70% of the market. In 2024, China accounted for over 75% of global processing of tellurium, cobalt, molybdenum, silicon, rare earth elements, magnesium, graphite and gallium, and more than 50% of vanadium, titanium, lithium, indium, germanium and antimony.

"China has successfully established extensive production chains over the course of several decades. As a result, it has become financially unviable for other countries to extract or manufacture these products independently," explained Natalia Velichko, a partner at Kept, in an interview with Expert. As an example of China's dominant role in this sector, Alexey Kobzev, project manager at Yakov & Partners, cites rare earth metals, for which China accounts for 60% of global extraction and 91% of processing, according to the IEA. He attributes China's success in this regard primarily to the robust support provided by government-sponsored initiatives.

For a number of minerals, including tantalum, titanium and vanadium, viable alternatives to China are currently "limited or subject to significant trade-offs in cost and supply", according to the IEA report. The situation is not expected to improve in the short term.

The IEA report states that 55% of critical minerals are currently subject to "some form of trade restrictions", namely sanctions or non-sanction tariff measures by individual countries. These further exacerbate the situation and create additional risks for the supply of raw materials to the global market.

As cited in the review, the situation with Russian aluminium is an illustrative example. As part of sanctions restrictions, the United States has imposed 200% duties on Russian alluminium since February 2023, and the European Union has completely banned its purchase. Last year, RUSAL, Russia's largest aluminium producer, saw a 7% decrease in primary aluminium sales compared to 2023, with sales standing at 3.86 million tons. This marks the worst result since 2019.

However, the restrictions imposed on Russia by consumers of critical minerals also impacted the country itself, according to Boris Kopeikin, chief economist at the Stolypin Institute for Growth Economics. This has led to an increase in logistics costs and a reorientation to other suppliers, he explains.

"Russia is a major producer of aluminium, nickel, cobalt, titanium and some other metals. However, with the exception of nuclear fuel, there is no critical dependence of the global economy on Russian supplies, in contrast to those from China, the Democratic Republic of Congo (DRC), Indonesia and some other countries," he adds.

Consequently, Russian manufacturers have successfully adapted their business strategies to alternative sales markets. Andrey Petrov, Director of Wealthy Clients at BCS World of Investments, notes that the Chinese market has already become the primary export destination for many of our clients in 2023. According to him, Rusal has doubled its aluminium exports to China compared to 2022, and Norilsk Nickel has increased its nickel and copper exports to Asia by more than 70%.

Petrov asserts that the global copper market has undergone a substantial redistribution as a result of the intensification of the trade war between the US and China. In March 2025, China, the largest consumer of this metal, reduced its purchases from the US by almost 50% and increased them from Russia by 2.7 times, he says. Consequently, Russia has emerged as the second-largest supplier of copper to China, after the Democratic Republic of the Congo (DRC).

Boris Kopeikin draws attention to the fact that sales in Asian markets are, of course, less profitable for Russian exporters: "The costs associated with operating in new markets are higher, and the price premiums are lower than in the USA and Europe."

A particular concern is the complexity of the technology for extracting many types of critical minerals. It is important to note that more than half of these minerals are a by-product of the extraction of more common and easier-to-obtain minerals.

For examle, tellurium, gallium and germanium are extracted during the processing of copper, nickel or aluminum ores. Consequently, their markets are inextricably linked. This further limits the flexibility of supply to the global market.

As stated in the IEA report, "This results in supply-demand imbalances: even if demand for the associated mineral increases, supply may remain limited when the base metal does not experience similar growth." A separate risk item that the agency's analysts point to is high price volatility, which sometimes exceeds the instability in oil and gas markets.

The review authors conclude that due to the relatively small size and "limited transparency" of critical mineral markets, even modest changes in supply or demand can cause significant price swings.

The IEA has identified issues in the report that are likely to create a challenging environment for investors and hinder the development of projects vital to the critical minerals market. This has resulted in a notable decline in investment momentum. Therefore, the authors of the report state that, after studying data on 25 major mining companies, investment grew by only 5% in 2024, following an increase of 14% in 2023. Investment in the exploration of minerals has increased steadily over the past three years, with a 20% annual growth rate from 2020 to 2023. However, this growth plateaued in 2024, reaching a total investment of $6.7 billion, which is equivalent to the previous year's figure.

According to the report, the global market may face a deficit of copper and lithium in the next 10 years. By 2035, the deficit in copper may reach 30% of global consumption. This is due to a decline in the quality of ore available for mining, rising capital expenditures, and "sluggish" exploration of new reserves. According to the IEA report, the lithium deficit in 2030 will be due to rapidly growing demand. In 2024, demand surged by 30%, significantly up from the 10% average annual growth rate seen in the 2010s.

The IEA classifies Russia as a country rich in raw materials that implements a policy of "extracting greater economic value from them." For instance, Russia is the second-largest global holder of REE reserves. According to the Russian Ministry of Natural Resources, the total amount is approximately 28.5 million tons. According to data from the US Geological Survey, China is the only country with a higher figure, at 44 million tons.

In June of last year, Alexander Kozlov, the Russian Minister of Natural Resources, stated that the country's raw material base is sufficient to meet global demand for rare earth metals for more than 100 years. Furthermore, the Russian Federation is home to 27% of the world's platinum group metal reserves, 22% of nickel, 15% of titanium, 13% of cobalt, 12% of tungsten, and 9% of copper.

The IEA does not provide a great deal of data on Russia, mentioning it mainly in the context of sanctions and its dominance of the enriched uranium market (more than 40% of global supplies).

At the same time, Russia has set the task of ensuring technological sovereignty over REE and rare metals, which will be addressed, among other things, within the framework of the national project "New Materials and Chemistry", designed until 2030.

In February of this year, the Russian President, Vladimir Putin, stated that within the framework of the national project, it is necessary to establish the entire line, the full cycle of the industry of rare and rare earth metals. This will ensure their extraction and processing up to the production of finished high-tech goods with high added value.

In July 2024, Industry Minister Anton Alikhanov announced that by 2030, Russia aims to increase its production of rare metals and REEs by eightfold, while reducing the share of imports to 15%. The plans include the production of 50,000 tonnes of large-tonnage rare metals (lithium, tungsten, titanium, zirconium, etc.) per year and 80 tonnes of small-tonnage rare metals (tantalum, beryllium, etc.). One of the key projects to increase production of rare earth metals is the development of the Tomtorskoye deposit in Yakutia. The deposit's predicted resources were previously estimated at 154 million tons of ore, and the REE content in the ores reaches 10-12% against the world average of 0.3-1%.

The state strategy also includes the creation of a high-tech manufacturing industry in Russia, a move which is expected to have a significant impact on the economy. A key element of this project is the restoration of Russia's capacity to separate REEs, which are currently obtained in the form of concentrate. The project is currently being executed by the state corporation Rosatom. One of the domestic consumers of REEs should be the first domestic large-scale plant for permanent rare earth magnets, which the corporation is building in the city of Glazov in Udmurtia. The production will consume 300 tons of REEs per year, and the magnets produced will be used to create wind turbines and drones.

Alexey Kobzev of Yakov and Partners has noted that Russia is developing its own full-cycle lithium-ion battery production, from mining lithium in the Murmansk region and hydromineral springs in Bolivia, to the production of lithium compounds in Novosibirsk and Angarsk, and finally the production of batteries.