Russia gains turbine independence

Russia has taken a significant step towards eradicating its critical dependence on Western high-power gas turbines. The launch of a thermal power plant with a turbine developed and produced entirely in Russia marks a significant milestone. This is a unique technological achievement for the country, which seemed unattainable until recently. For decades, Russia has been reliant on imports from Germany and the United States for this type of machinery

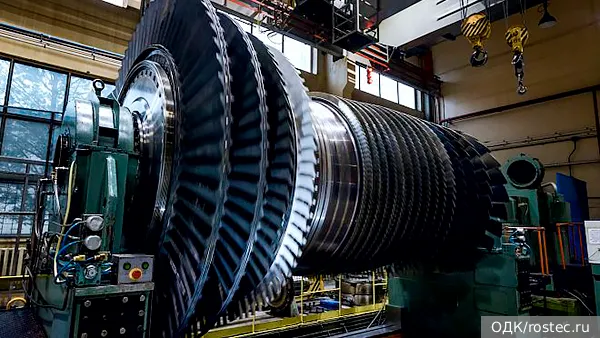

Russia has launched the first domestically produced high-power gas turbine, the GTD-110M. The turbine was installed in the third power unit of the new Udarnaya thermal power plant, which was commissioned in the Krymsk region of Krasnodar Krai with the participation of Russian President Vladimir Putin.

Prior to this, Russia had been reliant on foreign manufacturers for gas turbines of this capacity. However, Western manufacturers withdrew from the market, leaving Russia without access to these sorts of turbines.

"The development of new production facilities and the achievement of technological independence in this segment are significant milestones," stated Vladimir Putin.

Rostec highlights the key differentiators of the high-power gas turbine GTD-110M in comparison to its international counterparts. These include its reduced weight and dimensions, as well as its high fuel efficiency. The production process makes use of cutting-edge developments and pioneering technologies, including the additive manufacturing of combustion chamber components.

The engine will be deployed in gas turbine power plants and combined cycle power plants with an electrical capacity of 115 MW. Previously, turbines of similar capacity had to be purchased from Western companies, in particular from Siemens, GE and Alstom, which were forced to leave the country due to the conflict in Ukraine.

The first such turbine has been delivered to the Udarnaya TPP. The next three GTD-110M turbines will be manufactured and delivered in 2025-2026 for the modernisation of the Novocherkassk GRES. The production plan is to release two such turbines per year. However, from 2028, UEC (part of Rostec) plans to double serial production to four power plants per year. This will be made possible by the construction of a new mechanical assembly complex in Rybinsk.

HSE experts have determined that Russia's reliance on imported gas turbines reached 90% in 2022, representing a significant vulnerability in the country's energy security. However, following 2022, the two main suppliers, Siemens and General Electric, ceased their operations in Russia and withdrew from joint ventures.

Now before I continue I would like to make an appeal,if you like and enjoy my videos you can help me fund the channel and my websited sco brics insight .com and to further develop it. You can do this by making a small donation which you can do by clicking on the thanks button at the bottom of the video screen. Everybody who donates does get a personal thank you from me.

In light of these circumstances, the task of import substitution for high-power gas turbines has become even more urgent. Russia has only been able to manufacture low-power turbines, and previous attempts to develop its own high-power gas turbine have not been successful.

The issue of the lack of high-power gas turbines has been identified for some time, and efforts have been made to address it until 2022. Some of this work was conducted in collaboration with our Western partners, notably Siemens. The decision was taken to utilise the technology and expertise of the German company. As subsequent events demonstrated, this course of action proved to be unproductive. "However, our own developments were also carried out, and we are now seeing the results of that work," says Alexander Frolov, Deputy Director General of the Institute of National Energy and Editor-in-Chief of the industry media InfoTEK.

In addition to Rostec, Power Machines is also developing 65 MW and 170 MW gas turbines. The Rostec turbine is relatively compact in size. Mr. Frolov believes that such power should not be limited for the tasks facing the industry.

Mr. Frolov believes that the demand for such turbines in Russia will be very high in the next 25 years at least. A significant number of power plants in Russia are ageing and require modernisation or replacement. Furthermore, the growing demand for electricity is creating a need for new gas power plants to be built.

The total installed capacity of all power plants in Russia (not solely gas-powered) is approximately 263 GW. Of this capacity, 30 GW were constructed between the early 1990s and the early 2010s, with a further 50 GW built since the early 2010s. "The majority of other power plants are significantly older, with many constructed in the 1960s and 1970s. Some of these facilities are nearing the end of their operational lifespan and require modernisation," states Alexander Frolov. In general, power plants have a long service life, typically designed for more than one decade.

By 2030, we must address the issue of 100 GW power plants. This does not imply that they need to be replaced, but rather that we must ensure they are properly maintained. These power plants are relatively old and it is important to ascertain which can be modernised, which can continue to operate effectively and which need to be replaced. It is estimated that approximately half or two-thirds of these power plants will remain operational until 2030. However, by the 2040s and 2050s, they will clearly need to be replaced. "It is evident that these are not solely gas-powered facilities; there are also nuclear and coal-powered facilities, but gas-powered facilities represent the majority," states Frolov.

Meanwhile, demand for electricity in Russia is not decreasing, but growing. It is likely to reach 1,100-1,200 billion kilowatt-hours by the end of the decade, according to the expert. This indicates that, in addition to replacing turbines at existing power stations, it will be necessary to construct new power plants. Accordingly, there is a possibility that the capacity for serial production of such turbines will be insufficient to meet existing demand.

In 2028, just eight of these turbines will be assembled, at a rate of two per year. From 2028, production will increase to four units per year. In other words, 18 high-power turbines will be produced by 2030. Concurrently, Russia's requirement for these turbines may exceed 40 units.

This is the precise number of turbines that was agreed upon in 2022, when Russia and Iran reached a purchase agreement.

There are plans in place to modernise the power plants and to produce new gas turbines. If a Russian manufacturer is unable to produce the necessary equipment within the projected timeframe of 15 years, it may be necessary to explore alternative options, potentially in countries such as Iran and China. It is probable that there will be a deficit of gas turbines in Russia, even with our own production. The Russian market is substantial, and there will be numerous suppliers interested in selling us their turbines. "The same Siemens, which was effectively forced to leave Russia, is not at all pleased with the current situation," states Alexander Frolov.

To clarify, there are approximately 310 gas turbine units currently in operation in Russia, and each will require replacement at some point in the future. Furthermore, the cost of a single turbine is estimated to be between 3 and 4 billion rubles. This market has the potential to generate billions of dollars in revenue for turbine suppliers, not including the costs of spare parts and scheduled repairs.

Russia must develop the capability to build and produce turbines with greater capacity, according to the expert. In spring 2022, prior to the conclusion of an agreement to purchase 40 gas turbines from Iran, the import duty on MGT-70 gas turbines manufactured by Iranian Mapna was lifted. This indicates that there is a clear need for such turbines in Russia. Furthermore, the Iranian turbine has a greater capacity than the Russian GTD-110M, with an output of 185 MW compared to 115 MW for the Russian turbine.

Meanwhile, Siemens gas turbines of even greater capacity were installed in Crimea, which resulted in a scandal within the German company. Power Machines has initiated a project for a GTE-170 gas turbine with a capacity of 170 MW, and the first serial model has already been manufactured. Furthermore, the First Deputy Prime Minister of the Russian Federation, Denis Manturov, announced in September that plans are being considered for the serial production of gas turbines with a capacity of 300-400 MW.

A gas turbine is a large, highly efficient piece of machinery, comparable in size to a small house, which can meet the energy needs of an entire city, albeit a relatively small one. The announcement by Rostec of the release of the first Russian serial high-power turbine, the GTE 110M, is a significant development. We can now consider not only the possibility of replacing Western products, but also the potential for competing with Western equivalents. This is a significant technological achievement. "This technology is a driver of economic growth for the country," states Pavel Sevostyanov, Acting State Advisor of the Russian Federation and Associate Professor of the Department of Political Analysis and Socio-Psychological Processes at the Plekhanov Russian University of Economics.

In the long term, there is potential for Russia to export its high-power gas turbines. "The post-Soviet space is a priority for many countries seeking to enhance their energy security. "These turbines have the potential to become an export product, although this is a longer-term goal," Frolov concludes.