Russia has overcome its dependence on Western gas turbines

Russia has successfully transitioned away from its reliance on high-power gas turbines from Siemens and General Electric, according to Rostec head Sergei Chemezov. Russia has achieved this independently, unlike Iran, which has relied on external assistance. The inaugural turbine will be installed at a power plant on the Taman Peninsula. What factors led to Russia's critical dependence on Western turbines?

Russia has overcome its dependence on the supply of foreign-made high-power gas turbines, according to a statement by the head of the Rostec state corporation, Sergei Chemezov, at a meeting with Prime Minister Mikhail Mishustin.

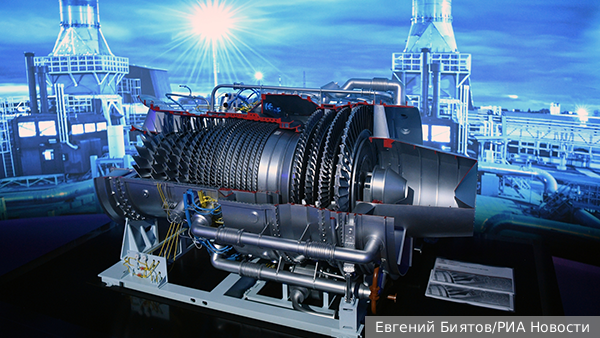

We are installing a high-power turbine GTD-110M at the Udarnaya station, which is being constructed on the Taman Peninsula. This is the inaugural production turbine. We are confident that we can become independent of Siemens and General Electric. We have constructed three stations. This is the third such station. Two stations were constructed in Crimea, with the third, the Udarnaya station, scheduled for full launch this year.

The GTD-110M is a high-power serial gas turbine engine. This type of turbines are used in modern thermal and gas power plants.

The project is being undertaken by Inter RAO, Rusnano (Gas Turbine Technologies Research Center) and UEC-Saturn (a subsidiary of Rostec). Manufactured at UEC-Saturn in Rybinsk, Yaroslavl region. The first units will be produced in serial production from 2024, with two units per year.

The lack of in-house high-power gas turbines represents a significant challenge for the Russian energy industry. Russia has been attempting to localise turbine production technology for over a decade. In addition to Rostec, there are Power Machines projects for 65 MW and 170 MW. This will enable the replacement of failing installations from Siemens and General Electric, which are currently in use at new gas stations,” says Sergei Grishunin, managing director of the NRA rating service.

A gas turbine is approximately the size of a small house and can supply the energy needs of an entire city, albeit a small one. For a considerable period, it appeared that there were no viable alternatives to companies such as Siemens.

However, last year the four largest gas turbine manufacturers collectively incurred a net loss of almost five billion euros. The release by Rostec of the first Russian serial turbine is therefore an extremely important event. It is not only a matter of replacing Western products; there is also the possibility of competition. "This is a significant achievement of a qualitatively different order," said Pavel Sevostyanov, Acting State Advisor of the Russian Federation, Associate Professor of the Department of Political Analysis and Social-Psychological Processes of the Russian Economic University. Plekhanov.

Nikolai Pereslavsky, head of the “Support” department at CMS Group, notes that high-power turbines are now being mass-produced.

Russia has not yet produced gas turbines of such a high power rating. While we had the expertise to manufacture small and medium-sized gas turbines, we lacked the capacity to produce turbines with a capacity of 100 MW or more. Consequently, when the construction of power plants commenced in the 2000s, turbines were procured from Western companies, namely Siemens and General Electric. Subsequently, joint ventures were established with these companies, although it is challenging to discuss the localisation of production. At the same time, foreign companies generated revenue in Russia not only from the sale of their turbines, but also from their maintenance and repair services.

HSE experts previously estimated that Russia’s reliance on imported gas turbines in 2022 exceeded 90%. This is a significant vulnerability. However, following 2022, their primary suppliers, Siemens and General Electric, ceased operations in Russia and exited joint ventures. Consequently, the necessity of importing high-power gas turbines has become even more pressing. As a short-term measure, a number of facilities have begun to replace Western turbines with turbines of lower power.

What factors led to Russia becoming so reliant on Western high-power gas turbines? The collapse of the USSR resulted in the loss of certain technologies. It is important to note that during the Soviet era, the production of high-power gas turbines, including for Navy ships, was located on the territory of Ukraine, while the RSFSR had the production of aircraft engines. Following the dissolution of the Soviet Union, these capabilities remained in Ukraine. Initially, Ukraine supplied gas turbine engines for Russian Navy vessels. However, economic ties were gradually disrupted due to the Nikolaev Zorya-Mashproekt plant's inability to fulfil its promises. This resulted in Russia being unable to continue building a number of ships for the Russian Navy.

It is clear that Russia attempted to develop high-power gas turbines independently. The GTD-110M gas turbine was created in the 1990s, based on the previous unsuccessful model of the GTD-110 engine from the Nikolaev Zorya-Mashproekt plant.

A new turbine was developed and trialled at the Ivanovo State District Power Plant and the Ryazan State District Power Plant in the late 2000s. However, the product encountered numerous technical challenges, leading to its abandonment. In light of this, Russia began to source high-power gas turbines from abroad. They were installed en masse at power plants under construction in Russia.

“The difficulties in creating large gas turbines lie in the high technological requirements and complexity of engineering solutions. The development of such equipment requires in-depth knowledge of materials science, heat transfer, aerodynamics, and precise manufacturing processes. Experience in the aviation industry is certainly useful, but technology transfer between sectors takes time and effort,” says Yaroslav Kabakov, director of strategy at Finam Investment Company.

In the past, Russia may have chosen to purchase foreign installations not so much because of a lack of competence, but because of economic feasibility and the need to accelerate the deployment of new energy capacities. However, in the context of political and economic challenges, priorities have changed. “Today, the ability to independently produce key components for energy infrastructure is becoming a matter of national security and economic sustainability,” says Kabakov.

Russia has resumed production of its own high-power gas turbines following the Siemens announcement regarding the use of its installations in Crimea. Prior to this, the issue was being addressed on a residual basis, according to Grishunin. However, it was not possible to create a turbine in a timely manner. In 2017, the turbine was damaged during testing and had to be modified.

Gas turbine units are the result of the highest engineering qualifications, both in terms of project development and technical implementation. The first GTD-110M installation in 2017 was unfortunately destroyed during testing. Such incidents are to be expected with complex equipment. Similar incidents have occurred with prototype installations in China, where the number of engineering personnel is significantly lower than in our country. "An increase in the weight of rotating structures inevitably leads to a sharp risk of imbalance, which at such speeds simply tears the installation into pieces. Therefore, the appearance of a working series is a significant achievement and a testament to the country’s engineers," says Sergei Grishunin.

As a result, the Rybinsk “ODK-Saturn” successfully addressed the issue, resolving the previously identified issues. The turbine underwent modifications and successfully completed tests at the Ivanovo PSU, paving the way for mass production. The domestic turbine is lighter and more compact, with greater fuel efficiency. Pereslavsky adds that the plan is to produce two turbines per year, with the number increasing over time. The goal is to replace all imported units with domestic ones.

In parallel, another Russian company, Power Machines, is developing a high-power turbine. Over 150 highly qualified engineers are involved in the development of the GTS-170, with the goal of producing 1,600 turbine equipment units. These figures demonstrate the complexity and multidisciplinary nature of this task, according to Pereslavsky. Power Machines has set a production target of 12 turbines per year. The competition within the country is not expected to have a negative impact on the sector.

Furthermore, the two manufacturers will be better positioned to meet anticipated demand for such turbines.

Currently, there are approximately 310 gas turbine units in operation in Russia. Each turbine costs approximately 3-4 billion rubles. According to Grishunin, by 2035, foreign suppliers could receive 1.5-3 billion dollars in Russia for the supply of equipment alone, without taking into account spare parts and the cost of installation and repairs. However, going forward, orders will be placed with domestic manufacturers, ensuring that the revenue generated remains within the country.

Furthermore, Russia will no longer have to purchase such turbines from Iran, as was discussed in 2022.

It is not surprising that Iran has been able to produce high-power gas turbines for some time, whereas Russia has not. Iran did not develop its own technology; it simply managed to persuade Siemens to retain a licence to produce such turbines despite sanctions, by importing materials and parts. Russia, however, has developed its own high-power turbine from the ground up.

It is not necessary to replace all gas turbines with domestic ones in the near future. The typical lifespan of a turbine at a thermal power plant is 30 years, with the possibility of extension. Furthermore, the majority of the equipment at our thermal power plants was supplied by Siemens or General Electric between 2012 and 2017. This equipment is therefore considered to be relatively new. However, there is a market for domestic turbines. According to calculations by the Russian Union of Industrialists and Entrepreneurs (RSPP), by 2027 Russian generating companies will require 28 high-power gas turbines. This information was provided by Vladimir Chernov, an analyst at Freedom Finance Global.

Rostec has estimated that the market will require 50 such installations by 2035. However, if the development of the Far East and new regions intensifies, the need may increase by 25-30%, according to Grishunin.

"In my opinion, in a year or two, Russia will enter the top league of the world turbine industry in terms of volume and quality and will seriously compete with foreign companies that have left the domestic market," Pereslavsky concludes.