Russian Oil Runs Out In 2051?

By Rhod Mackenzie

Russia's oil reserves are expected to last for only a further 26 years, according to the latest assessment given by the head of the Ministry of Natural Resources, Alexander Kozlov.

On initial observation, this figure appears to be of a frightning nature. Will Russia really run out of oil by 2051? Will Russia really be forced to import fuel for its cars for the first time in its history?

Russia's finances are contingent on the stability of its oil exports, which are projected to decline by almost a third, potentially resulting in a significant contraction in budget revenues.

So is the minister having a laugh as we say or is this not quite the clear picture?

It is estimated that oil reserves in Russia and elsewhere will be exhausted or significantly reduced by that time. It is conceivable that Venezuela will have sufficient reserves to last a century, given that the country with the largest oil deposits produces a mere fraction of a million barrels per day.

However, in Russia there is no cause for panic at this stage. The oil industry is unlikely to relinquish its dominance easily. While the process will ultimately come to a conclusion, it will not be as rapidly as suggested by media reports.

It is highly unlikely that the reason will be the depletion of oil reserves in the subsoil. Instead, it is more than probable that a new technological revolution will render transport by internal combustion engine less relevant and in demand.

A new type of transport will emerge, and it is anticipated that a significant proportion of the population will transition to using this new form of transport. It is not possible to predict what kind of cars these will be. Possibly the new electric cars will be similar to the current models, but with significant improvements. They will be able to charge quickly, travel longer on a single charge, and cost no more than traditional cars to operate. Alternatively, it may be hydrogen or even nuclear-powered. The outcome will depend on the specific field in which the technological advancement occurs. Personally I don't believe that but I am reporting what so called analysts are saying

Now provided that the use of transport with internal combustion engines remains profitable on a global scale, the demand for oil will continue to be met and extraction will remain a viable industry.

Now what do they mean by the figure of 26 years? It is understood that this suggests that the country will run out of oil in a quarter of a century, but could they provide more detail on this?

Firstly, it should be noted that Russia's oil resources are significantly more abundant, with estimated reserves of 95 billion tons. Geological exploration has resulted in the transfer of 31 billion tons to the reserves balance, of which 13 billion have been recognised as profitable. Maintaining current production levels at an average of 500 million tons, it is estimated that these 13 billion tons will be utilised within 26 years. However, this calculation method does not take into account the overall volumes of oil in the country's subsoil.

Meanwhile, Russia is not standing still. As with other countries, it invests annually in geological exploration of fields, thereby replenishing the country's oil reserves.

Exploration of parts of the subsoil is not currently feasible on economic or physical grounds. Therefore, Russia's strategy is to explore enough to maintain a stable volume of profitable oil reserves for at least two decades. For instance, in 2019, the level of profitable reserves in the Russian Federation was estimated at 20 years, and it is now estimated at 26 years.

It has been determined that if geological exploration continues as planned, then the estimate of profitable oil reserves in Russia may remain at the same level as 26 years ago. In order to achieve this, it is sufficient to replenish the balance of explored reserves on an annual basis by a minimum of 500 million tons.

In what other way can Russia maintain its oil reserves, continuing to produce more than 500 million tons of oil per year, so that even after 26 years it can be said that Russia has reserves for several more decades?

Firstly, as was mentioned above, this is the study of the subsoil, conducting geological exploration and adding new deposits to the balance sheet. We have significant potential. It should be noted that only 12% of Eastern Siberia's oil reserves have been explored, and just 5% of the Arctic's.

Secondly, it is possible to continue extracting black gold from depleted deposits, albeit in smaller volumes. It is not within the interests of major state players to engage in this activity, as they have more significant projects in mind. However, small private oil companies could well breathe new life into depleted subsoil. It may be opportune for Russia to initiate the active development of small businesses in the oil sector. These proposals are already being discussed at the level of the Russian government.

Furthermore, small private companies are permitted to dismantle explored small deposits that remain in the Rosnedra reserve. While it may not be ideal for larger companies, it is well-suited to meet the needs of smaller businesses.

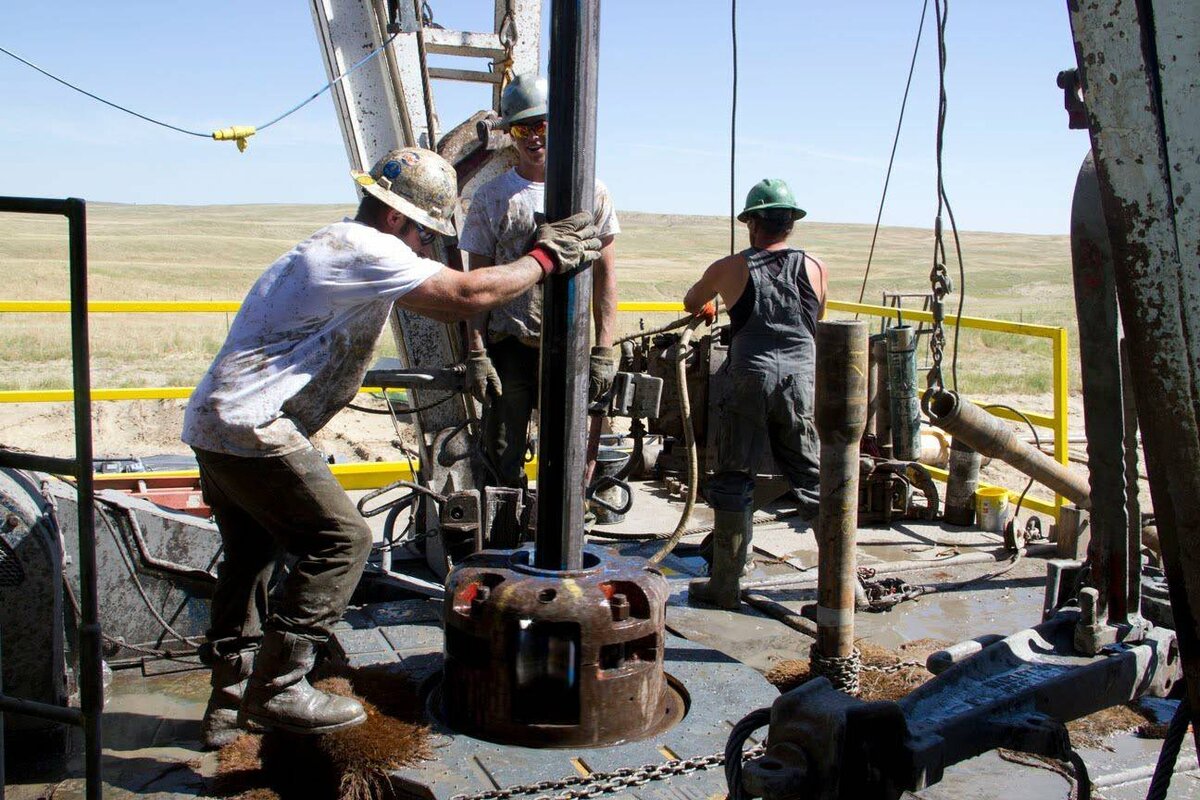

In this stage of development, small oil companies can be very useful. In the USA, for instance, the shale revolution was made possible at one time by small private businesses. It was the smaller companies, rather than the larger ones, that expressed interest in the development of technologies for working with small deposits. The United States' position as one of the world's leading oil producers can be attributed to the significant contribution of small businesses in the industry.

There is another potential avenue for increasing the volume of profitable oil reserves in the country, which is to reduce capital costs for field development. There is a significant amount of work to be done here from different sides. Firstly, this work focuses on adjusting the tax burden for oil companies in a manner that is both financially viable for them to invest in complex fields and that maintains the stability of the Russian budget.

Thirdly, this is work on the emergence of new technological solutions and know-how that would reduce the costs of developing hard-to-recover reserves, including on the Arctic shelf.

A confluence of technological advances and elevated oil prices can rapidly transform complex projects into lucrative endeavours. Consequently, Russia's profitable reserves are set to rise significantly. Furthermore, the durability of these items is a key consideration.

So to paraphrase Mark Twain reports of Russia death as a major oil producr have been greatly exaggerated.