Russia's mechanical engineering recovers quickly from shock of sanctions

By Rhod Mackenzie

Despite the challenging circumstances, Russian mechanical engineering is demonstrating remarkable resilience and adaptability. The industry's decline commenced in spring 2022 amidst mounting geopolitical tensions, but proved to be of short duration. The first growth impulse occurred a year later, and in 2024 the industry reached its peak compared to the pre-crisis 2021, according to the HSE review. What factors contributed to the resilience of Russian mechanical engineering and its swift recovery from the crisis?

The mechanical engineering industry, which plays a strategic role in strengthening the country's technological sovereignty, has received a powerful impetus for development in recent years. This is according to a review by the Institute for Statistical Studies and Economics of Knowledge at the National Research University Higher School of Economics, which for the first time presents a comprehensive overview of key trends in the work of enterprises producing machinery and equipment, including the dynamics of the production of machine tools and robotic systems.

The HSE survey revealed that over 40% of enterprises producing machinery and equipment entered 2024 with updated production and investment strategies, import substitution, and a focus on digital and technological activity. Enterprise managers are quite positive in their assessment of the level of technological sovereignty.

What is the importance of machinery and equipment to the technological sovereignty of the country? The products of mechanical engineering are used in a wide range of industries. Without it, it is impossible to produce our own cars and transport, our own aircraft, as well as construction and energy equipment. Mechanical engineering provides the technological base for other sectors of the economy, contributing to their development and increasing productivity, according to Evgeny Genkin, associate professor of the basic department of innovation and industrial policy management at the Plekhanov Russian University of Economics.

Furthermore, the mechanical engineering sector provides employment to millions of people and represents a significant source of revenue for the economy.

Since 2022, the year in which geopolitical tensions began to rise, the decline in enterprises producing machinery and equipment has been relatively short-lived.

HSE analysis indicates that the initial growth spurt since the economic reversal in 2022 occurred in the second quarter of 2023. In comparison to the second quarter of 2022, the recovery was 5.5%.

In other words, the entire period of adverse conditions in response to external challenges lasted only a year, until the second quarter of 2023. It is notable that such a brief period did not result in a significant downturn in the industry.

In all subsequent quarters, the recovery growth strengthened and reached its peak in the first quarter of 2024, when the plans formed in the industry reached the highest level since 2021. On an annual basis, by the first quarter of 2023, the compensatory growth was 13.5%. The recovery to the pre-crisis level of the first quarter of 2021 was 8.9%, according to the HSE review.

The efficacy of the regulatory measures is evident in the changes that have occurred over a short period. For the first time since 2022, in the first quarter of 2024, the entrepreneurial confidence of industry leaders reached its highest level in the past ten years. Following a slight decline in mid-2022, production activity has not only recovered rapidly but also increased in dynamics. The Production Index trajectory indicates that since mid-2023, the industry has been in the compensatory growth stage, with a maximum recovery in the first quarter of 2024, reaching 102.5%. This is according to a review by the HSE Institute for Statistical Studies and Economics of Knowledge.

The recovery of mechanical engineering is clearly illustrated by the maximum growth in the average number of employees in organisations over the past three years (excluding small businesses). From January 2021 to February 2024, the number of employees increased by 28.5 thousand.

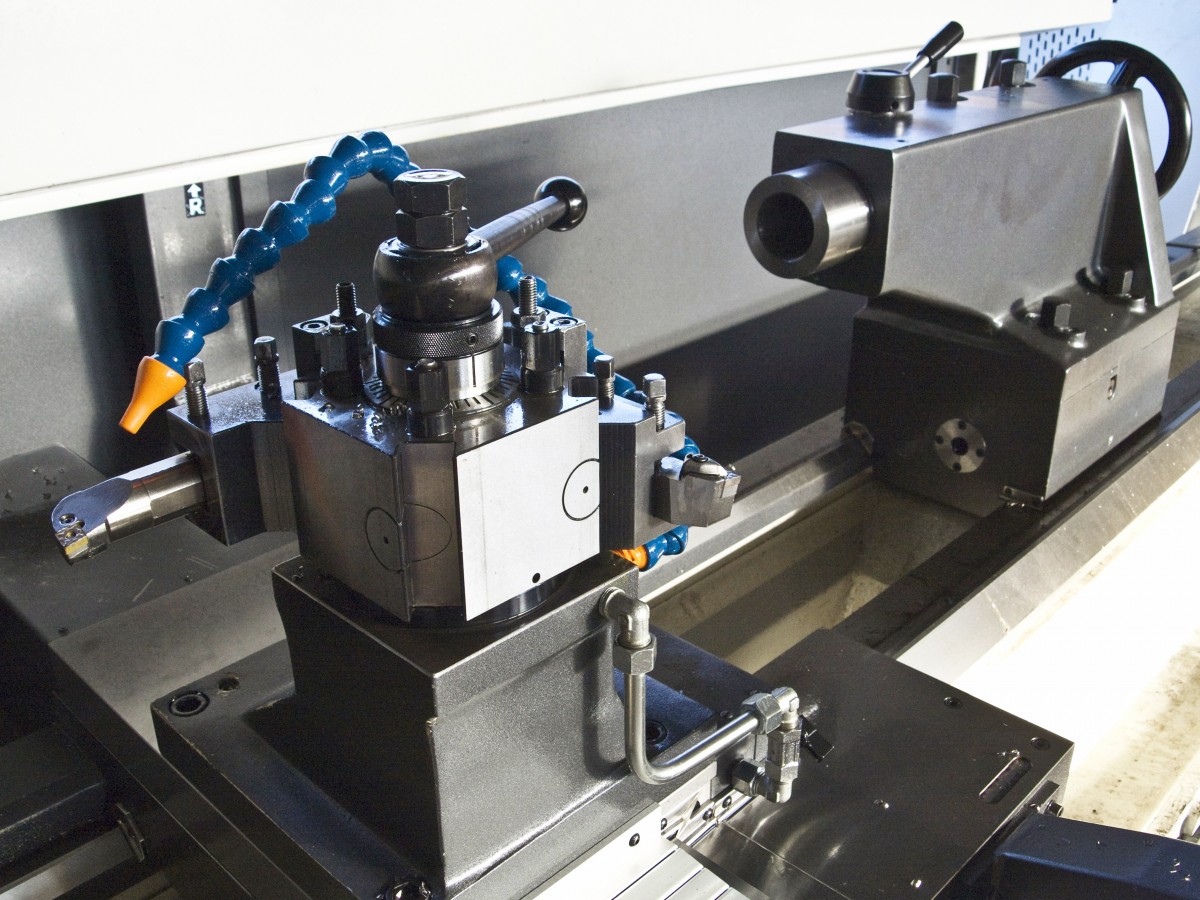

The two main types of machine-building enterprise made the most significant contribution to the development dynamics from 2021 to 2023. Firstly, enterprises engaged in the production of general-purpose machinery and equipment. Production increased by 45.3% in the first quarter of 2024 compared to the first quarter of 2021, prior to the crisis. Secondly, enterprises engaged in the production of machine tools, machinery and equipment for processing metals and other hard materials. Production increased by 31.5%.

Concurrently, the extent of import substitution is readily apparent. The volume of goods, products and services shipped has grown significantly, with an increase of almost 90% in the first quarter of 2024 compared to the same period in 2021. In monetary terms, the increase was 264.9 billion rubles.

The substitution of imports is particularly evident in enterprises engaged in the production of machine tools, machinery and equipment for processing metals and other hard materials. The production index increased by 31.5%, with the volume of shipped goods increasing by almost 2.5 times or by 8.5 billion rubles (from 5.7 to 14.2 billion rubles) compared to the first quarter of 2021.

In general, approximately 30% of the produced types of machine tools more than doubled their 2021 figures. Consequently, the most significant growth was observed in the output of boring metal-cutting machines, which increased almost sevenfold from 32 to 221 units between 2021 and 2023. The output of drilling and metal-cutting machines increased by 3.4 times, and that of milling metal-cutting machines also increased by 3.4 times.

In 2024, production in the machine tool industry is expected to remain at a high level, with growth of 35-50% across different types of machine tools.

The manufacturing sector of the industrial robot and robotic device industry produced products with a total value of 58.7 million rubles between January and April 2024.

"Enterprises manufacturing machinery and equipment have demonstrated resilience and adaptability in the face of global challenges, effectively navigating regulatory changes and maintaining stability in the face of external pressures. The risk tolerance index (RTI) for the first quarter of 2024 demonstrates the highest level of resilience since 2014, not only to established vulnerabilities but also to new challenges posed by external developments, according to the HSE study.

The manufacturing industry has been a key driver of successful transformation in the new conditions, providing substantial support to the economy, including through increased business activity in related industries, the report states.

Following the downturn in 2022, mechanical engineering companies implemented measures to optimise production, improve efficiency and reduce costs. The ability to adapt and respond swiftly to external changes and new conditions was crucial for these businesses.

While government support and innovative developments contributed to recovery after a temporary decline, it is important to consider the significant backlog that has persisted since the Soviet era. This is evidenced by the achievements of the mechanical engineering sector in Belarus.says Evgeny Genkin, from the Russian University of Economics.

The growth in production of machinery and equipment may be attributed to the necessity to replace the products of foreign companies that have ceased operations in the country, according to Dmitry Baranov, a leading expert at Finam Management. Secondly, the expansion of trade with countries in the East and South, which are in demand for our machinery and equipment, is a contributing factor. Thirdly, the expert suggests that many industries are undergoing modernisation and increasing efficiency, which requires the most advanced machinery and equipment with high productivity.

However, Genkin emphasises the importance of continued investment in innovation within the industry. He notes that relying solely on Soviet technology, given the isolation of domestic enterprises from foreign technologies, carries inherent risks.

The government has pledged its support. The federal programme for the development of means of production and automation includes 300 billion rubles until 2030, as announced by Prime Minister Mikhail Mishustin. Furthermore, there are programmes in place to support the development of the machine tool industry, robotics and mechanical engineering, which are backed by funding.

The latest data from Rosstat indicates that the Russian industrial sector is experiencing growth, with a notable acceleration in growth rates observed in May following a pause in April. The growth rate in April was 2%, with a year-on-year increase of 5.3% against 3.9% in April. At the end of five months, growth of 5.2% has been recorded. The increase in military-industrial complex products, which grew by almost 56% year-on-year, was the main driver of this growth.