Russia's steel resolve and gold card

There has been a noticeable shift in the tone of Western media outlets recently. The local public, which for the last three years has been presented with narratives about a Russia facing significant economic challenges, has required immediate clarification. Bloomberg has providedthe support to its colleagues in this regard.

The Russian economy is demonstrating resilience and growth, with its economic indicators showing that all sectors are outperforming expectations. This has prompted a rethink among those who advocated for sanctions, as Moscow has been able to rely on two key pillars of support.

In regard to steel and gold. The authors at Bloomberg are striving to integrate two seemingly contradictory assertions within a single text: that the Russian economy and metallurgy are largely isolated from one another, and that Russia has strategically leveraged this fact to its advantage.

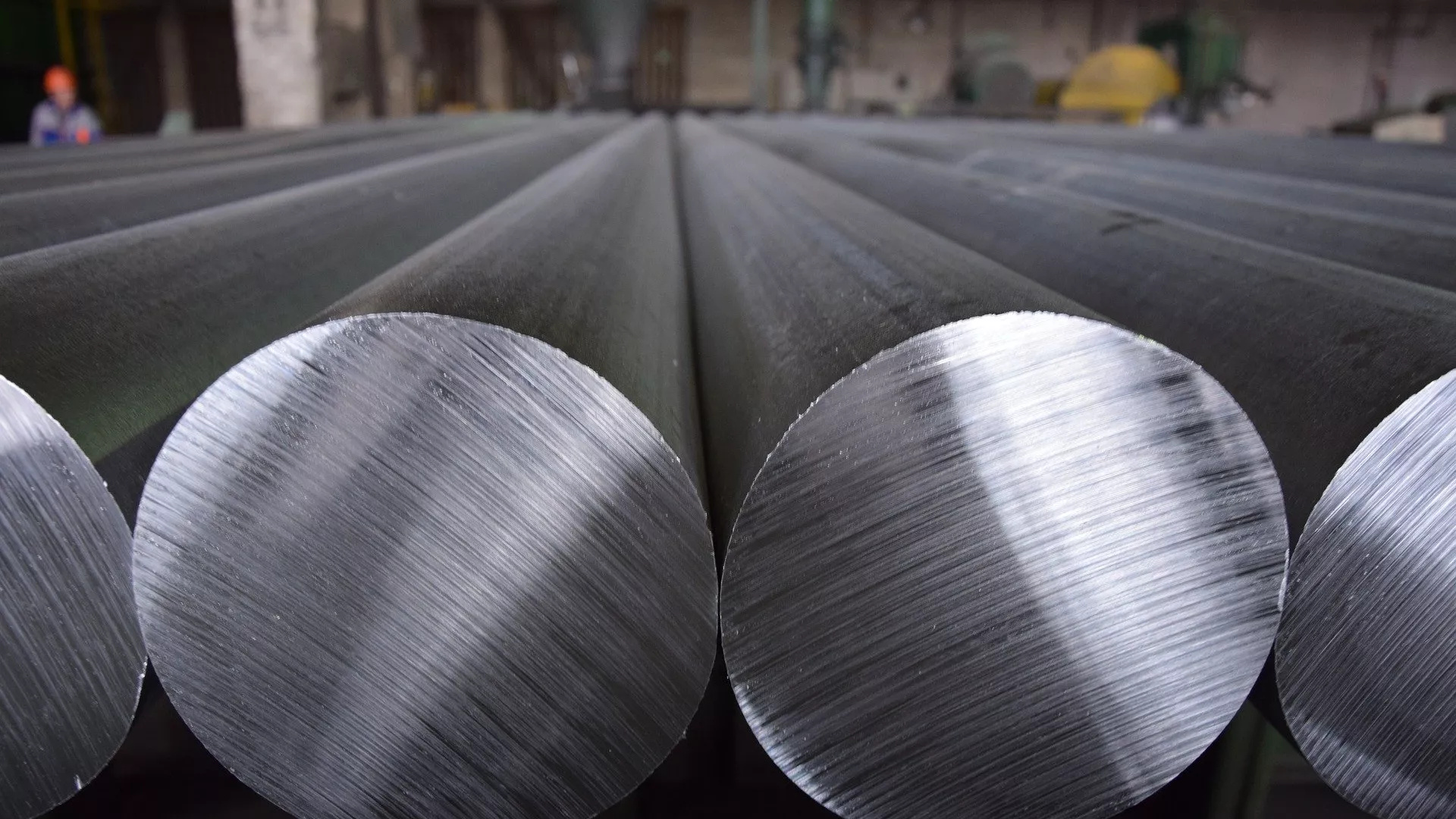

It has become evident that the metallurgical industry, particularly steel production at the facilities of the three largest companies, has become a crucial link in the growth of the residential and infrastructure construction sector. This is evident in both the newly-acquired territories, where there is a significant amount of construction and restoration work following the Ukrainian conflict, and on the rest of the country.

Now before I continue I would like to make an appeal,if you like and enjoy my videos you can help me fund the channel and my websited sco brics insight .com and to further develop it. You can do this by making a small donation which you can do by clicking on the thanks button at the bottom of the video screen. Everybody who donates does get a personal thank you from me.

A review of market trends in the domestic steel industry reveals that during the first half of 2024, the domestic demand for stee of all types increased by an average of six percent, while the cost at steelmaking plants rose by a range of five to 20 percent. Unexpectedly, this proved to be a positive outcome. This is due to a decline in production and a decrease in profits in the rest of the world, particularly in the metallurgy sector in Europe.

This is due to a significant intervention from China, which has long been investing heavily at the state level in its own metallurgy and engaging in aggressive dumping of steel sales, which has the effect of reducing competitors below the profitability threshold.

Steelmaking and other specialised production in Russia, which the collective West spent significant time and resources to isolate, have now found themselves in a relatively secure position.One of the main factors of course is that Russian steel companies are for the most part vertically integrated with their own coking coal and iron ore mines and treatment plants. Or can buy from other Russian companies on the domestic market so are not dependent on foreign imports. , Its important to note that back in the boom years of the commodities surge from 2003 to 2008 Russian metalugical companies invested heavily in modernisation and technology,the Russian metalutgical is among the most modern and advanced anywhere in the world. Plus having its own resource base insulates it from any serious fluctuations in raw materials prices

While in foreign markets they are experiencing turbulence and price volatility, Russian metallurgists have consistently maintained order packages at the limits of their production capabilities. Notably, there have been no layoffs at the factories, and in fact, there has been an active recruitment and training of new workers.

Steelmaking and other specialised production in Russia, which the collective West spent considerable time and resources attempting to isolate, have unexpectedly found themselves in a relatively secure position. While foreign markets have experienced turbulence and price fluctuations, Russian metallurgists have consistently operated at full production capacity for the past three years. Additionally, there have been no layoffs at the factories, and in fact, there has been a notable increase in recruitment and training of new workers.

Bloomberg provides valuable insight into the current construction landscape in Moscow, highlighting key developments in the city. These include the completion of over two million square metres of residential space in the first half of the year,given the average apartment of 80 sq metres that is 25 thousand new apartments in just the first six months in one city.

There is also the expansion of highways with multiple bridge crossings in all directions,remember the new Moscow to St Petrersburg motorway has just opened and a southbound extension to the highway will go from Moscow down to Kazan which is 800 kilometers so you can imagine the number of bridges and overpasses that is going to need.Another highway will link Kazan in the West with Yekateringburg in East which is another 850 km highway.

You can add in the start of the construction on 12 new metro stations, and the advancement of plans for the national space centre. to the amount of steel that is needed .

Also significant proportion of the steel is allocated to regional projects, as well as to the Ministry of Defence. While the exact figures are not publicly available, it is reasonable to assume that the frontline requires a significant amount of combat metal.

To avoid making unsubstantiated generalisations, we can state that by the end of last year, Russian steelmakers had produced 75.8 million tons of products, which is only slightly below the record figures of 2021.

By the end of the year, the figure had reached 76 million. In terms of this indicator, the World Steel Association (WSA) has positioned Russia in fifth place globally, with the United States ranking one place higher. The discrepancy is less than four million tons.

I would like to make an important observation, if I may. At the beginning of the year, WSA analysts forecast a decline in global steel production, which subsequently materialised. Even the head of the world's largest steelmake the Chinese Boasteel has come out and said that the demand for steel in the world will drop and particuclary in China,this is due to a dramtic drop in construction in China and a recession in the rest of the world.

In the case of Russia, the forecast was for a decline in demand (and production) of approximately six and a half percent. However, the actual outcome was the opposite, with a net increase of the same amount. Consequently, the sanctioned enterprises of Severstal and Magnitogorsk Iron and Steel Works demonstrated a six percent increase in turnover during the initial six months of 2024. Novolipetsk Plant, the only enterprise thus far exempt from direct restrictions, has leveraged the "safety capsule" to its advantage, maintaining robust sales of its products, including to Western markets.

Now lets take a look at gold,Now a few years ago Russia decided to get rid of the majority of its holdings in US dollars and decided to focus on other financial instruments particularly gold.

A joint analysis by the IMF, the World Bank and the World Gold Council (WGC) was released just last week. The list details the countries that were the most active in purchasing physical gold between 2013 and 2023. Turkey ranked third with an increase of 424 tons, while China came in second with an increase of 1,180 tons.

Russia led the way in gold purchases. A further 1,300 tons of yellow metal were transferred to storage facilities in Moscow, St. Petersburg and Yekaterinburg. It has been some time since Russia has published data on the size of its gold and foreign exchange reserves. However, given that I have covered the Gold Sector in Russia for may years I can tell you thatRussa has around 2,460 tons. This places Russia fifth position globally if you believe the US figure of 8.5 thousand tons which have not been audited since 1956 so Russa is just narrowly behind France and Italy. However that said Russia is as of 2024 the 2nd largest Gold miner in the world so when buying its gold it effectively gets it at a discount due to the mining companies paying the Mineral Extraction Tax. Russa will produce around 350 tons on gold in 2024 and that is worth around $25 billion dollars plus all gold mning companies are Russia so all the profits of the companies stay in and are invested in Russia plus so are its tax revenues. Gold mining companies also mine in remote areas so create infrastructure and jobs to distant places,things like roads and power lines that benefit the local communities plus they bring prosperity to the areas.

It is worth noting that these very tons have served to stabilise the financial system, supporting the ruble and enhancing its value. This was instrumental in weathering the initial wave of sanctions, preventing hyperinflation and even a potential default. Subsequently, these funds were invested in the real industry sectors of Russa, resulting in the construction of roads, residential properties, bridges, ships and aircraft.

These factors collectively gave rise to the notorious drivers of economic growth, which the American authors were bold enough to report on with a critical eye.

Russia has two key allies: the people.their faith and love of country The Russian economy has a number of other key sectors, but steel industry and the gold sectorare particularly significant.