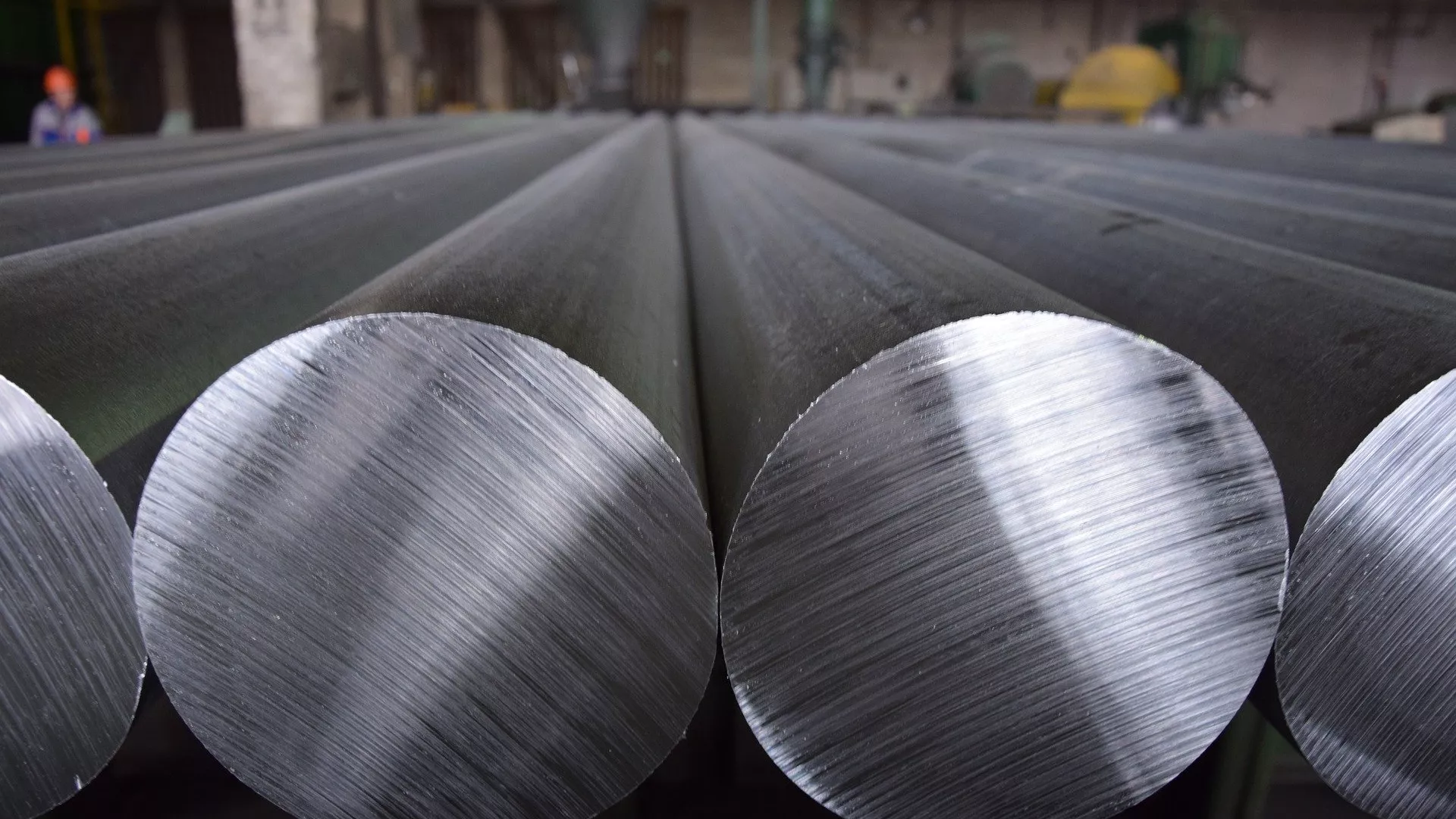

US,UK sanction Russian aluminium,copper and nickel on their exchanges

On Friday, the US and UK imposed new restrictions on the of trading Russian aluminium, copper, and nickel in an attempt to curb President Vladimir Putin's ability to fund his military operations according to their staement .

Bloomberg reports that new supplies of copper, nickel, and aluminum produced on or after April 13 cannot be delivered from Russia to the London Metal Exchange, where global benchmark prices are set, as well as to the Chicago Mercantile Exchange. Additionally, the US is banning Russian imports of all three metals.

However, similar to the case of oil sanctions, these sanctions are merely for show as they will not hinder Russia's ability to sell its metals. This is because non-US individuals and entities are not restricted from purchasing physical Russian copper, nickel, or aluminum. Although the LME plays a crucial role in establishing global prices, most metals are traded between miners, traders, and manufacturers without ever passing through an LME warehouse. Since 2022, the share of Russian metal sales to China has substantially increased as some Western buyers have sought alternative suppliers.

According to Bloomberg, the new restrictions are expected to impact prices on the LME, which serve as a benchmark in numerous contracts worldwide. The LME prices, especially for aluminum, have been under pressure for months due to the increase in Russian metal supply, causing non-Russian supplies to trade at a premium.

The sanctions will also impact traders' willingness to handle Russian metal. Many traders consider the ability to deliver on the LME as essential, and some contracts include clauses specifying that they will be void if the metal is no longer LME-deliverable.

This implies that the metal, similar to Russian-sourced oil, will probably be traded at a lower price compared to other sources. This will result in reduced revenue for Russia, while still allowing the metal to enter the global market and avoiding the impact of full-scale sanctions on crucial raw materials. Meanwhile, global commodity merchants such as Glencore, Vitol, and Trafigura will earn billions as intermediaries, assisting buyers in evading sanctions. In 2022, Russian metal exports were valued at $25 billion, and in 2023, they were valued at $15 billion.

“We will reduce Russia’s earnings while protecting our partners and allies from unwanted spillover effects,” US Treasury Secretary Janet Yellen said in a joint statement with her UK counterpart, Jeremy Hunt, who added that the move “will prevent the Kremlin funneling more cash into its war machine.”

The imposition of sanctions will likely result in increased commodity prices. However, it may also raise questions for Glencore, one of the largest traders of Russian metal due to a long-term contract with Rusal.

Russia is a significant producer of three metals, accounting for approximately 6% of global nickel production, 5% of aluminum, and 4% of copper. Despite this, Russian supplies make up a much larger percentage of metal on the LME. By the end of March, Russian metal made up a significant portion of the nickel, copper, and aluminum in LME warehouses, accounting for 36%, 62%, and 91%, respectively.

To gain a practical perspective on the impact of the sanctions, The commodity trading giant Goldman Sachsr trading desk has published a note discussing the short and long-term effects of the delivery ban.

According to them its worth remembering this Is not a complete sanction on Russian metals

This only effects the US and UK markets and most Russian aluminium copper and nickel will simply bypass the exchanges in the West and deal direct with countries or intermedeiries as they have done with Gold and Silver after the LBMA banned Russian gold. It simply went to the Dubai Gold and Commodities Exchange ande the Shanghai Gold Exchange. They will have little problems finding buyers like they did for their oil.

Its not as if these two exchanges trade huge volumes of Russian metal but are mainiy for setting bench mark market prices used around the world for physical trading of actual metals.

Will China take up extra Russian supply? Yes, but it will take a little time as it adjusts its supply chains . Chinese demand for aluminium continues to increase as it does for copper and nickela

The question remains: what will be the impact on prices? Yesterday's announcement did not reduce the supply of spot metal to the global market outside of China. End-users are not restricted from consuming Russian metal, and US consumption of Russian metal is already essentially zero. Additionally, Rusal (aluminium) and Norilsk (nickel) will not immediately divert supply to China due to arbitrage economics and capacity constraints. Rusal currently transports aluminium by rail to Northern China, while Norilsk struggles to price up against Shanghai and Hong Kong Futures exchange because of Indonesia's supply growth, which is tolled via China. History has taught us that the market will price in a 'full-sanction' risk premium and the markets will just continue.

Also note as I previously discussed, Russian oil is now trading above the western embargo price virtually everywhereso the effects of the sanctions remains to be seen but probably like all the rest of the sanctions imposed they will be a minor inconvinience for short while and then it will be business as usual for Russia and its partners in the BRICS and around the world .

What will change is the speeding up of the countries of the BRICS and their allies who have already announce the setting up of a grain exchange,plans to have a system for trading with each other in local currencies up and running in the near future so its only a matter of time before they set an independent platform for the trading of commodities bearing in mind that Russia is a major producer as China of metals ( China in paricular in rare earth metals essential for all modern devices,from phones to computers and othe sophisticated equipment) with other BRICS countries large consumers so expect an announcement soon on the plans for a commodities exchange to by pass yet another parasitic Western insitution.